Bonds/Forex 목록 ( 총 : 21,866)

-

Key Market Focus for UK Autumn Budget—BOE Rate Path and Pound Sterling

The UK Autumn Budget is set to introduce major tax hikes amid a £20–35 billion shortfall, with markets watching for impacts on the Bank of England’s rate path and continued pound weakness.

-

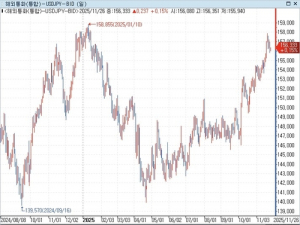

Japanese Authorities Consider Yen Intervention – Why the Next Month Is Critical

Japanese authorities are considering direct intervention as the yen approaches historic lows, with the next month seen as crucial for currency direction amid key policy decisions from the BOJ and the Fed.

-

New Zealand Dollar Extends Gains Against US Dollar Despite RBNZ Rate Cut—Up 0.91%

New Zealand dollar rises 0.91% against the US dollar, defying expectations after the Reserve Bank of New Zealand's rate cut.

-

Finance Ministry Says Special US Investment Bill Enables Retroactive 15% Auto Tariff from November 1

South Korea’s National Assembly has introduced a special bill enabling the retroactive reduction of US-bound auto tariffs from 25% to 15% effective November 1, following a Korea-US strategic investment MOU. The bill establishes a $20 billion annual investment cap, creates a Korea-US Strategic Investment Fund and Corporation, and mandates compliance with MOU safeguards. The move aims to reduce export uncertainty for Korean automakers, pending US Federal Register publication.

-

Ruling Party Proposes Special Act on US Investment—'Hopes for Active Cooperation from People Power Party on Bill Passage'

South Korea's Democratic Party has proposed a special act to facilitate $350 billion in strategic US investments, establishing a Korea-US Strategic Investment Corporation with 3 trillion won in capital, and is urging bipartisan support for swift passage as the US prepares to lower auto tariffs.

-

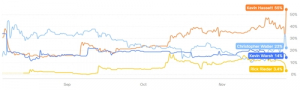

Dollar-Addicted Markets Await Shift to Dollar Weakness as Key Driver for Exchange Rates

The USD/KRW exchange rate remains elevated amid diverging forecasts on a potential global dollar reversal in 2025, with major institutions split on whether dollar weakness will materialize as capital flows and US growth prospects continue to drive market direction.

-

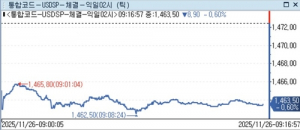

Dollar-Won Falls Below 1,460 During Session—Hits 1,457.00

South Korean won strengthens as the dollar-won exchange rate dips below the 1,460 mark, reaching 1,457.00 during intraday trading.

-

The Ministry of Economy and Finance Says It Will Not Exhaust This Year’s Treasury Bond Issuance Limit

South Korea’s Ministry of Economy and Finance signaled it will not fully utilize this year’s Treasury bond issuance limit, aiming to stabilize the bond market amid rising yields and volatility.

-

[Seoul Foreign Exchange Market]Dollar-Won Hits Five-Day Low—Caution Ahead of Deputy Prime Minister's Briefing, Hopes for Russia-Ukraine Ceasefire

The dollar-won exchange rate dropped to a five-day low, driven by hopes for a Russia-Ukraine ceasefire and expectations of U.S. Fed rate cuts, while markets remain cautious ahead of a key briefing by South Korea's Deputy Prime Minister.

-

Dollar-Won Plunges Over 10 Won Intraday—Hits 1,460.80 at One Point

The Korean won surged against the US dollar, with the exchange rate dropping more than 10 won intraday and briefly touching 1,460.80, signaling heightened volatility in the currency market.

-

[Short-term Money Market Analysis]Reserve Shortfall Expected in South Korea's Money Market

South Korea's short-term money market is expected to face a reserve shortfall on the 26th, with liquidity conditions tightening despite fiscal disbursements and ongoing volatility in call and repo markets.

-

Government Bond Futures Open Higher as Market Awaits Monetary Policy Board Decision

South Korean government bond futures opened higher as U.S. Treasury yields declined, but trading remained cautious ahead of the Bank of Korea’s Monetary Policy Board meeting, with investors watching for signals on future rate policy.

-

Kevin Hassett Emerges as Frontrunner for Next Fed Chair—Betting Odds Surpass 50%

Kevin Hassett has emerged as the leading candidate for the next US Fed Chair, with betting markets placing his odds above 50% for the first time, outpacing Christopher Waller and Kevin Warsh.

-

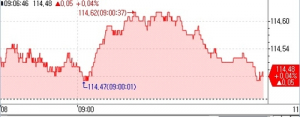

[Seoul Foreign Exchange Market]Pre-Open MAR 'Flat' Trading—Fixing Square

South Korea's won-dollar market opened flat on November 26, with pre-market MAR quotes and NDF fixing positions both indicating a neutral stance among traders.

-

Dollar-Won Plunges Over 9 Won, Hits Intraday Low of 1,463.00

The Korean won surged against the US dollar, with the exchange rate dropping more than 9 won to an intraday low of 1,463.00, signaling heightened volatility in the currency market.

-

Gu Yoon-cheol Says US Investments Must Become Strategic Opportunity to Lead Global Value Chains

South Korea's Deputy Prime Minister Gu Yoon-cheol urged leveraging US investments to lead global value chains, vowing bold support for AI, autonomous vehicles, and renewable energy to drive the nation's super-innovative economic transformation.

-

National Pension Fund Explores Measures to Minimize FX Market Impact—Parallel OTC Transactions with Major Institutions

The National Pension Service is considering flexible FX hedging and diversified OTC transactions with major institutions to minimize market impact amid rising currency volatility.

-

Dollar-Won Eases After Rally, But Positioning Uncertainty Deepens in Seoul FX Market

The dollar-won exchange rate eased after a recent rally, but uncertainty over policy direction and strong dollar demand are keeping Seoul FX market participants cautious about taking new positions.

-

[Today's FX Dealers' Expected Dollar-Won Range]

South Korean FX dealers expect the dollar-won rate to trade lower around 1,460 won, citing dollar weakness, risk appetite, and possible government intervention, with a potential move into the 1,450 won range if strong policy signals emerge.

-

End of Korean Paper Issuance—From US Dollars to Multi-Currency Funding Secured

South Korean companies have completed year-end funding in multiple currencies, with Korean Paper spreads at record lows, raising concerns over higher issuance costs in 2025.