Opinion 목록 ( 총 : 57)

-

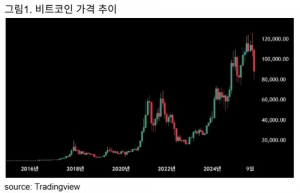

[Mi-seon Lee's Crypto ON]Cryptocurrency Plunge Spurs Strategic Shifts for Next Phase

The cryptocurrency market has entered a bearish phase following large-scale leveraged liquidations and potential MSCI index exclusions, with Bitcoin down over 30% from its peak. Regulatory uncertainty and new ETF approvals are reshaping how institutions hold digital assets, while systemic risks and evolving US policy continue to drive volatility and strategic shifts in crypto investment.

-

[Seung Hun Lee's Currency & Market]Exchange Rate Volatility and Liquidity Risk

South Korea’s won faces volatility as market jitters persist, but experts say current weakness reflects portfolio shifts, not a liquidity crisis, and urge structural reforms to bolster resilience against future FX shocks.

-

[Mi-seon Lee's Crypto ON]Payment Platform Embraces Cryptocurrency

Naver Financial to acquire Dunamu, operator of South Korea’s largest crypto exchange Upbit, in a landmark share swap, signaling a major shift in the nation’s fintech and digital asset landscape as stablecoin and blockchain integration accelerates.

-

[Seung Hun Lee's Currency & Market]The Market Must Find Its Balance

The dollar-won exchange rate surged past 1,400 amid US tariff negotiation uncertainty, with markets bracing for volatility as swap lines offer limited relief.

-

[Dong Hun Jang's Patriotic Investment]Let's Build a Robust Pension System

South Korea’s pension system faces urgent reform as demographic shifts and low returns threaten retirement security, with experts urging diversification and alternative investments to boost long-term yields.

-

[Sang Wook Chae's Real Estate Talk]Homes Under Construction Are Not Homes

South Korea’s latest housing supply measures shift targets from permits to construction starts, but market skepticism persists as actual completions lag and capital continues to flow into Seoul’s real estate market.

-

[Hee Kwon Kyung's Future Korea]Turnberry System

The US and EU have declared the end of the postwar Bretton Woods and WTO systems, launching the Turnberry System to revive manufacturing and reshape global trade, with the EU pledging zero tariffs and massive investment in the US.

-

[Mi-seon Lee's Crypto ON]401K Cryptocurrency Investments and the Prospects for Altcoin ETF Approval

US 401K retirement plans will allow cryptocurrency investments following a Trump executive order, potentially driving $178 billion in new inflows and accelerating ETF adoption, while SEC decisions on Solana and Ripple ETFs are expected in October amid prospects of a Fed rate cut.

-

[Seung Hun Lee's Currency & Market]Looking Ahead to a Balanced Message from Jackson Hole

The U.S. jobs report’s surprise slowdown has fueled market speculation over Fed rate cuts, but persistent inflation risks and divided Fed views point to a cautious policy stance ahead of Jackson Hole.

-

[Dong Hun Jang's Patriotic Investment]Key Investment Points for the Second Half of the Year

Global markets saw record volatility in H1, but US equities hit new highs; investors are urged to reassess equity, bond, alternative, and FX strategies amid shifting risks.

-

[Hee Kwon Kyung's Future Korea]Chairman, Our Chairman

Visiting Tesla's Nevada Gigafactory, the author highlights how large-scale manufacturing investment and Elon Musk's vision have revitalized local communities, inspired workers, and raised questions about South Korea's future industrial competitiveness.

-

[Mi-seon Lee's Crypto ON]Crypto Firms Seek Entry into Banking Sector and Direct Fedwire Access

The US Congress is set to vote on major crypto bills during "Crypto Week," as Ripple Labs and Circle seek trust bank charters and direct Fedwire access, potentially reshaping global cross-border payments.

-

[Seung Hun Lee's Currency & Market]Time to Focus on Fundamentals

The Korean won has entered a new phase, with the USD/KRW rate falling sharply amid easing uncertainties, but structural fundamentals and global dollar trends suggest volatility and potential for renewed upward pressure remain. Investors and policymakers are urged to focus on economic fundamentals and risk management as the market seeks new direction.

-

[Dong Hun Jang's Patriotic Investment]Potential Shift in Traditional Investment Paradigms

Global capital markets face a paradigm shift as U.S.-China tensions, rising rates, and changing capital flows challenge traditional investment strategies, prompting Korean investors to reassess risk and diversification.

-

[Sang Wook Chae's Real Estate Talk]Housing Prices Surge—A Far Greater Concern Than Instant Noodle Inflation

South Korea's housing market is surging, with Seoul home prices rising at the fastest pace since 2022, prompting calls for timely intervention as policy delays risk further overheating.

-

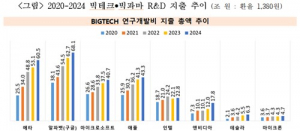

[Hee Kwon Kyung's Future Korea]Corleone Option

The article analyzes the potential impact of the extension of the U.S. Tax Cuts & Jobs Act (TCJA), dubbed the "Corleone Option," highlighting its sweeping tax incentives for R&D and manufacturing, the global investment race it triggers, and the challenges it poses for countries like South Korea and Japan in retaining advanced industries amid shifting U.S. policy priorities.

-

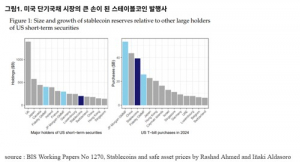

[Mi-seon Lee's Crypto ON]Impact of US Stablecoin Bill on Treasury Yields and Monetary Multiplier

The US Stablecoin Bill is poised to reshape global crypto markets, with projections of a six- to eightfold surge in stablecoin market cap, significant effects on US Treasury yields, and new challenges for monetary policy and financial regulation worldwide.

-

[Seung Hun Lee's Currency & Market]Let the Exchange Rate Move Freely

South Korea’s won surged to a seven-month high as market-driven dollar weakness and US-South Korea currency talks fueled sharp appreciation, but analysts warn against artificial intervention, urging policymakers to let exchange rates reflect fundamentals to avoid financial instability.

-

[Dong Hun Jang's Patriotic Investment]Issues and Implications of Japanese Institutional Investors' Asset Management

Japanese institutional investors focus on inflation hedging, alternative investments, and ESG 2.0 amid challenging market conditions, offering insights for Korean capital markets.

-

[Sang Wook Chae's Real Estate Talk]Top 10 Pledges and the New Government's Real Estate Market

Presidential candidates unveil contrasting real estate policies, with focus shifting from supply to economic growth and regional development amid changing market conditions