Stock 목록 ( 총 : 3,714)

-

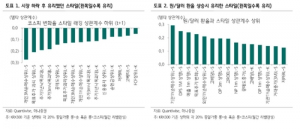

Retirement Pension Superstars Post 38.8% Annual Return—Thematic ETFs Drive Surge

South Korea’s top retirement pension investors posted a 38.8% annual return—nine times the average—by actively allocating to thematic ETFs and performance-based products, with the highest gains seen among those in their 40s, according to the Financial Supervisory Service.

-

Samsung Securities Maintains Stability with Executive Appointments—Park Kyung-hee, Lee Chung-hoon, and Lee Chan-woo Remain at the Helm

Samsung Securities Co., Ltd. reinforced stability in its latest executive reshuffle, retaining key division heads and promoting five new executives, as retail client assets near 400 trillion won and high-net-worth client numbers continue to rise.

-

'Is Selling 100 Billion Won in Treasury Shares Justified for a 5.8 Billion Won Need?'—Suspicious Math Behind Samyang Foods' Treasury Stock Disposal

Samyang Foods' sale of 99.4 billion won in treasury shares—despite only needing 5.8 billion won for expansion—raises questions over governance, regulatory avoidance, and the prioritization of short-term investors, drawing sharp criticism from market experts and the Korea Corporate Governance Forum.

-

'Father of Leverage' Kim Doo-nam Promoted to Executive Vice President at Samsung Asset Management—Set to Drive ETF Market Leadership

Samsung Asset Management has promoted Kim Doo-nam, a pioneer of South Korea’s ETF market and known as the “Father of Leverage,” to Executive Vice President, reinforcing its leadership as competition intensifies in the 200 trillion won ETF sector. Kim, who launched Asia’s first leveraged and inverse ETFs, will drive further innovation and market dominance for the KODEX brand, with a focus on digital marketing and asset allocation strategies.

-

US Rate Cut Hopes and Google AI Optimism Lift KOSPI by 0.4%

South Korea's KOSPI rose 0.4% as optimism over a potential US Fed rate cut and positive sentiment around Google's AI Gemini 3.0 boosted investor confidence, with tech and construction stocks leading gains.

-

NH Investment & Securities Provides Timely Funding—A Lifeline Amid VC Matching Capital Drought

NH Investment & Securities commits 100 billion won ($76 million) to venture and tech funds, easing South Korea's VC matching capital crunch and signaling increased private sector participation.

-

[Meritz Securities Capital Increase] Credit Over Cash—Why the CPS Plus Put Option Strategy Is a Game Changer

Meritz Securities launches a 500 billion won CPS issuance with a put option via SPC, boosting capital strength while minimizing holding company leverage; the structure offers high yields and principal protection, signaling confidence in profitability.

-

[Meritz Securities Capital Increase] Eyes on 'No.4' IMA Beyond Issuance Notes—Approaching 8 Trillion Won

Meritz Securities moves closer to the 8 trillion won capital mark with a major rights offering, aiming to expand its business scope and surpass Samsung Securities in equity capital rankings.

-

Foreign Selling Not a Bearish Bet on Equities—Time for Patience, Not Panic

Foreign investors’ recent selling in the KOSPI is driven by temporary supply-demand imbalances, not fundamental weakness, with analysts urging patience over panic selling as the market enters oversold territory.

-

KOSPI Correction Phase—Focus on Semiconductors and Oversold Earnings Plays

Hana Securities advises investors to focus on semiconductor and oversold blue-chip stocks during the KOSPI correction, citing a prolonged tech boom and new opportunities in high-dividend plays.

-

Meritz Securities to Raise KRW 500 Billion via Third-Party Allotment—Secures Foundation for IMA Expansion

Meritz Securities will raise KRW 500 billion ($380 million) through a third-party allotment of convertible preferred shares, boosting its capital base to support expansion into the IMA business and strengthening its position among South Korea’s top securities firms.

-

NH Investment & Securities Makes 315 Billion Won Preemptive Venture Capital Investment Ahead of IMA Designation

NH Investment & Securities Co. will invest 315 billion won ($240 million) in venture capital for innovative industries and SMEs ahead of its IMA designation, aiming to accelerate its shift toward productive finance.

-

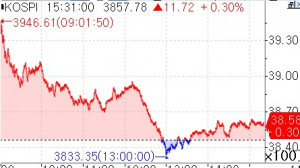

[Market Close] Persistent Early Strength, Late Weakness—KOSPI Ends Firmly Above 3,800

South Korea's KOSPI index closed above 3,800, maintaining early gains despite late-session weakness, as foreign buying offset domestic selling; tech and power stocks outperformed while Samsung EpiSys Holdings plunged on debut.

-

Financial Regulators and Prosecutors Hold 4th Joint Council Meeting—Review Progress of Stock Price Manipulation Response Task Force

South Korea’s financial regulators and prosecutors reviewed the progress of their joint task force against stock price manipulation, highlighting strengthened enforcement, new surveillance systems, and ongoing efforts to enhance market transparency and fairness.

-

KOSPI Repeats 'Strong Open, Weak Close' Pattern as Investor Sentiment Stalls at 1,470 Won FX Barrier

South Korea’s KOSPI index erased most early gains as the strong dollar-won exchange rate near 1,470 continued to weigh on investor sentiment, despite positive global cues and robust performance from Samsung Electronics.

-

Mirae Asset, Samsung Securities Appointed as Lead Underwriters for MyRealTrip IPO

MyRealTrip, a leading South Korean travel platform, has appointed Mirae Asset Securities and Samsung Securities as underwriters for its IPO, targeting the nation's first OTA listing with projected 45% annual growth and 2.3 trillion won in transactions.

-

'Concept Inspired by K-Pop Demon Hunters'—Samsung Active Asset Management Launches K-Culture Value Chain Active ETF

Samsung Asset Management has launched the KoAct Global K-Culture Value Chain Active ETF, targeting key K-pop, food, and beauty companies and global platforms, with ambitions to expand its thematic ETF offerings and achieve single-digit market share next year.

-

'Stick Investment Urged to Reinvest Dividends—Long-Term Shareholder Align Partners Proposes Growth-Focused Strategy'

Activist fund Align Partners urges Stick Investment to cut near-100% dividend payouts and reinvest in GP commitments, citing low ROE and global PE standards; also calls for treasury share cancellation to address governance risks.

-

Broadcom Draws Attention as a Derivative Bet on Alphabet’s AI Ecosystem—Target Price Raised

Broadcom shares soared 11.1% as investors bet on its role in Alphabet’s AI ecosystem, with analysts raising target prices amid surging demand for custom AI chips.

-

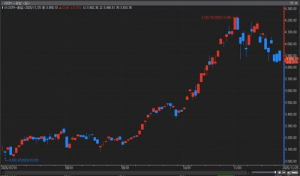

KOSPI Rallies Over 2% in Early Trade, Approaching 4,000 Mark—Isu Petasys Soars

South Korea's KOSPI index surged over 2% in early trade, nearing the 4,000 mark, as optimism over Google's AI boosted tech stocks; Isu Petasys soared 16.55% while Samsung Electronics and SK hynix posted strong gains.