(Seoul=Yonhap Infomax) Kyu Sun Lee – The recent weakness in South Korea’s benchmark KOSPI index is attributed more to a temporary supply-demand vacuum than to deteriorating fundamentals, according to market analysts, who advise patience over panic selling.

Ki Hoon Park, research analyst at Korea Investment & Securities Co., stated in a report on the 26th that, “The current downturn in the domestic equity market cannot be fully explained by external uncertainties or fundamentals alone. It is necessary to view the situation through the lens of supply-demand dynamics.”

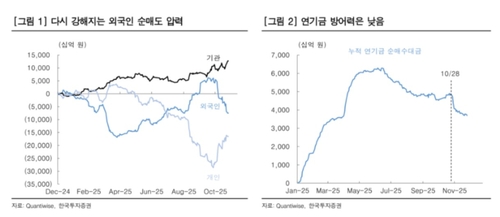

Park noted that since late October, foreign investors have turned to net sellers, while heightened currency volatility has weakened the defensive stance of major institutional investors such as pension funds, which traditionally act as a market stabilizer.

However, Park highlighted that despite rising market fear—reflected in the VKOSPI volatility index—and continued foreign outflows, the futures basis has remained stable.

“Typically, sharp market declines are accompanied by speculative selling in the futures market, leading to a deteriorating basis and a vicious cycle of mechanical sell-offs. Currently, however, the basis remains resilient,” Park explained.

This suggests that the ongoing selling is less a speculative bet on a bearish market and more likely a result of structural rebalancing in the cash market or portfolio adjustments ahead of November’s book-closing period.

Korea Investment & Securities Co. assessed that the KOSPI has technically entered oversold territory.

“Since late last week, foreign investors have shifted to net buyers in the futures market, and the index has reached the lower band of the Bollinger Bands, signaling an oversold condition,” Park said. “The likelihood of a further sharp decline appears limited.”

Regarding investment strategy, Park advised, “At this point, joining in panic selling or aggressively increasing cash allocations may not be prudent. Investors should maintain positions in sectors with robust earnings power and exercise patience amid volatility.”

*[image2]*

kslee2@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction or redistribution, and AI learning or utilization, are strictly prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.