(Seoul=Yonhap Infomax) Gyeong Eun Park – So-called “retirement pension superstars” have outperformed average participants by as much as ninefold in annual returns, according to new data.

Top performers allocated nearly 80% of their portfolios to performance-based products such as funds and bonds, while actively leveraging thematic ETFs for dynamic management strategies.

The Financial Supervisory Service (FSS) on the 26th released its “Korea Retirement Pension Investment White Paper,” unveiling the investment approaches of the highest-returning pension participants.

The FSS selected defined contribution (DC) participants who have maintained accounts for over three years at leading banks, securities firms, and insurers, with account balances exceeding 10 million won ($7,700). The agency analyzed the investment strategies of the top 100 performers in each age group, totaling 1,500 individuals.

As of the end of Q2 this year, the top retirement pension investors posted a one-year return of 38.8%. Their average annual return over the past three years was 16.1%. Both figures far outpaced the average participant returns of 4.2% (one year) and 4.6% (three years)—a difference of 9.2 times and 3.5 times, respectively.

By sector, participants with a more aggressive risk appetite in the securities sector achieved a three-year return of 18.9%, outperforming those in banking (15.1%) and insurance (13.1%).

By age, those in their 40s recorded the highest returns, while top performers aged 60 and above, either retired or nearing retirement, favored more stable investment strategies over aggressive ones.

Regardless of age, “superstar” investors maintained a high allocation—79.5%—to performance-based products such as funds and bonds. They also kept 8.6% of assets in cash or equivalents, allowing for rapid response to market conditions.

By fund type, equity funds accounted for the largest share at 70.1%. Mixed bond funds made up 9.0%, indicating a strategy of maximizing equity exposure while adhering to risk asset limits.

Within domestic funds, allocations were concentrated in thematic products such as shipbuilding, defense, and nuclear power. For overseas funds, investments focused on U.S. big tech equity funds.

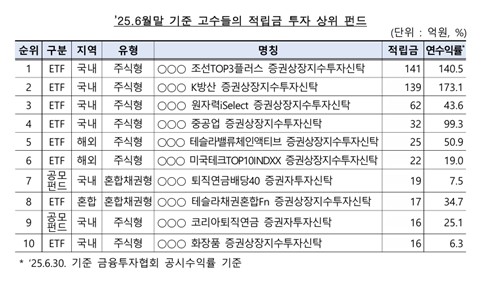

The preference for ETFs was also evident in retirement pension portfolios. By collective investment vehicle, ETFs comprised 75.1% and public offering funds 24.9%. Eight of the top 10 most-invested collective investment products were ETFs, while target date funds (TDFs)—popular among general participants—were not selected by top performers.

By age group, younger participants concentrated on U.S. index ETFs. Those in their 30s and above actively managed portfolios by investing in thematic ETFs or funds linked to blue-chip companies such as Tesla.

Even among top performers aged 60 and above, thematic ETFs were favored. At the same time, they increased allocations to high-dividend and China-focused funds, reflecting a preference for balanced portfolios.

gepark@yna.co.kr

(End)

Copyright (c) Yonhap Infomax. All rights reserved. Unauthorized reproduction, redistribution, AI training and use prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.