(Seoul=Yonhap Infomax) Kyu Sun Lee – Amid the recent correction in South Korea’s benchmark KOSPI index, analysts at Hana Securities recommend investors focus on semiconductor stocks and fundamentally strong names that have experienced excessive declines.

In a report released on the 26th, Kyung Soo Lee, senior researcher at Hana Securities, noted, “While concerns over a bubble in US big tech are impacting the Korean market, a different interpretation is possible from a mid- to long-term perspective.”

Lee highlighted the US government’s aggressive industrial policy, describing it as a form of “state capitalism.” He stated, “The US government is deploying exponential investments in artificial intelligence (AI), semiconductors, and biotech through subsidies, loans, and tax credits. Under the leadership of the Trump administration, monetary, fiscal, and diplomatic policies are being mobilized, making it likely that the big tech boom cycle will be longer and broader than in the past.”

As a result, Lee expects South Korea’s semiconductor sector to enter a new phase, moving beyond its traditional boom-and-bust cycles.

From an investment strategy perspective, with the KOSPI having corrected about 9% from its recent peak, Hana Securities sees opportunities in “oversold” stocks and high-dividend plays.

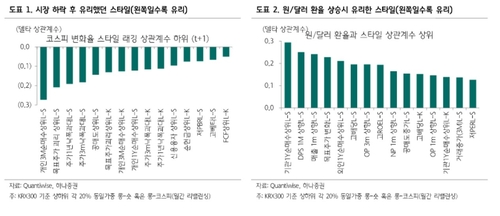

According to Hana Securities’ analysis of past market corrections and periods of won-dollar exchange rate appreciation, the following styles delivered relatively strong returns:

- Oversold stocks

- Top short-selling targets

- Stocks with high target price gaps

- Names with strong institutional net buying

- High-dividend stocks

Lee explained, “During periods of directional uncertainty following a pullback from index highs, stocks showing fundamental improvement signals—such as resilient earnings or upward target price revisions despite excessive price corrections—tend to outperform.”

Hana Securities identified the following as stocks with upward Q4 earnings revisions but significant price declines, resulting in high target price gaps: Hyundai Rotem, Samsung E&A, Mirae Asset Securities, and HD Hyundai Heavy Industries.

Additionally, stocks with enhanced dividend appeal due to recent price drops include Korea Financial Group, POSCO Holdings, Kia, Samsung Securities, and Woori Financial Group.

kslee2@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.