On June 12, Israel launched a surprise attack on Iran's nuclear enrichment facilities under Operation "Rising Lion." In the early hours of June 13, U.S. Secretary of State Rubio issued a statement declaring the strike was Israel's unilateral action and that the United States was not involved. However, shortly after, President Trump took to social media to repeatedly demand Iran halt its nuclear program. Iran refused, prompting Trump to warn that unless Iran ceased its nuclear development before it was too late, it would face further consequences, stating he did not want more death and destruction.

President Trump has repeatedly taken unilateral and often irreversible actions when his demands are not met, such as exerting comprehensive pressure on Ivy League institutions like Harvard and Columbia, deploying the National Guard during the Los Angeles riots, and launching global tariff wars. While the media focuses on issues like war, tariffs, and civil unrest, there appears to be another "Corleone Option" that may seem less dramatic but is equally significant: the extension of the 2017 Tax Cuts & Jobs Act (TCJA), or what Trump calls the "One Big Beautiful Bill Act" (OBBBA). Elon Musk has called it a "Disgusting Abomination."

Despite his penchant for controversy, President Trump seems to hold the OBBBA particularly dear. When the bill passed the House by a single vote (214 to 215), Trump warned that any lawmakers voting against it would be committing the "Ultimate Betrayal." He has repeatedly emphasized that this is the largest tax cut in U.S. history and the most critical policy for reviving domestic industry and manufacturing. While some question whether the bill is as significant as Trump claims, and others argue it will only add to the national debt, if enacted, it would substantially reduce the effective tax burden for companies operating within U.S. borders.

The bill, spanning over 400 pages, includes previously promised cuts to income and inheritance taxes, tax exemptions for tips and overtime pay, as well as increased budgets for the Golden Dome, naval shipbuilding, and oil and nuclear energy. Most of the green subsidies and tax credits from the Biden administration's Inflation Reduction Act (IRA) would be eliminated. Among the many provisions, one particularly noteworthy for corporate investment attractiveness is the immediate expensing of 100% of research and development (R&D) costs through 2029, though Senate negotiations are still ongoing.

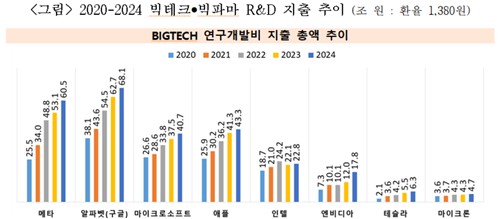

In 2024, Meta Platforms Inc. and Alphabet Inc. (Google) spent 60.5 trillion won ($45.7 billion) and 68.1 trillion won ($51.5 billion), respectively, on R&D. For comparison, South Korea's 2024 defense budget is about 61.6 trillion won ($46.5 billion). Combined R&D spending by Meta, Alphabet, Microsoft Corp., Intel Corp., NVIDIA Corp., Tesla Inc., and Micron Technology Inc. totals approximately 264 trillion won ($199.7 billion) in 2024. The top eight "Big Pharma" companies spent a combined 128 trillion won ($96.9 billion) on R&D. While the bill limits benefits to domestic R&D activities and prohibits double-dipping, the ability for thousands of companies to immediately expense over 1,000 trillion won ($756 billion) in R&D costs represents an unprecedented advantage.

The implications of the 100% R&D expensing provision are significant. Under the CHIPS Act, passed after 15 years of debate during the Obama and Biden administrations, Intel received less than 10 trillion won ($7.6 billion) in direct subsidies, yet spends over 20 trillion won ($15.1 billion) annually on R&D. If all of this could be deducted from taxable income for the next four years, the benefit would exceed that of two or three CHIPS Acts. While some companies, like Intel, currently have little taxable profit, others such as NVIDIA and Micron stand to gain substantially.

Additionally, although there is a $4 million cap, the OBBBA would allow 100% immediate expensing of qualified manufacturing facility investments through 2029—a potential lifeline for small and medium-sized enterprises. However, questions remain. The Trump administration previously imposed tariffs on China and other low-cost manufacturing countries for unfair trade practices like subsidies and tax credits. What will become of the global minimum tax (Pillar II), agreed upon by over 130 countries to set a 15% minimum tax rate for multinationals?

Regrettably, Trump declared on his inauguration day that the global minimum tax would not apply in the United States, aiming to attract massive foreign investment for economic growth, innovation, and job creation. Apple Inc. and NVIDIA have each announced $500 billion in U.S. investments, as have OpenAI, SoftBank Group Corp., and Oracle Corp. IBM Corp. plans $150 billion, Micron $200 billion, and Taiwan Semiconductor Manufacturing Co. (TSMC) $100 billion. Saudi Arabia, the United Arab Emirates, and Qatar have announced long-term U.S. investment plans of $600 billion, $1.4 trillion, and $1.2 trillion, respectively.

For countries like South Korea and Japan, which face high costs and structural challenges in attracting advanced manufacturing, the outlook is increasingly uncertain. Given the scale of these incentives and the future market potential, companies may find little reason to remain. Trump's "offer you can't refuse"—to hand over the backbone and future growth engines of the Korean economy—appears likely to be signed on July 4, Independence Day. Soon, new administration officials and business leaders will head to Washington, D.C., or Mar-a-Lago. While urgent issues like tariffs, defense costs, and exchange rates remain, it may be time to reassess domestic conditions to prevent the hollowing out of manufacturing.

(Kyung-kwon, Research Fellow, Industrial Research Institute)

jsjeong@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.