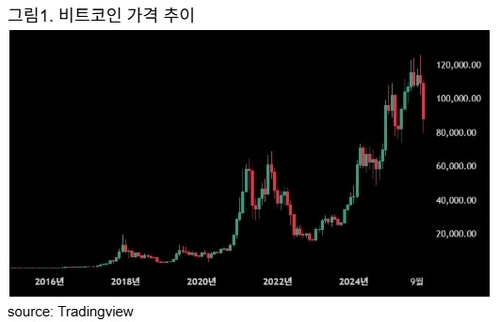

The cryptocurrency market has remained in a prolonged bearish trend for over a month and a half following a wave of large-scale leveraged liquidations on October 10. Bitcoin prices fell to $88,609 on November 25, marking a decline of approximately 30% from the previous high on October 6. Although the price briefly dipped to $80,572 on November 21, it has since partially recovered.

On October 10, the crypto market saw $16.7 billion in leveraged positions forcibly liquidated within just a few hours. This triggered a cascade of additional liquidations as collateral values dropped, resulting in significant losses for market participants.

The market capitalization of stablecoins—a key liquidity indicator for the crypto market—declined by 2% from its October 25 peak. Such a decrease is rare; it is the first contraction in crypto market liquidity since the Terra-Luna crisis in May 2022, when stablecoin market cap plunged by 34%.

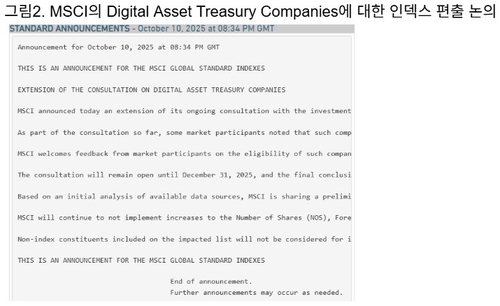

MSCI Considers Excluding Firms with Large Digital Asset Holdings

While the cause of the sudden market drop on October 10 was initially unclear, recent discussions around MSCI’s index rebalancing have been cited as a potential trigger. On October 10, MSCI reportedly proposed excluding companies from its global indices if their digital asset holdings exceed 50% of total assets.

This proposal initially went unnoticed, but a November 20 report from JP Morgan warned that if MSCI removes MicroStrategy (MSTR) from its index, up to $2.8 billion in passive investment funds could flow out. Should other major index providers such as Nasdaq and Russell follow suit, total outflows could reach $8.8 billion. The market has since recognized that MSCI was indeed considering such changes on October 10.

MSCI views companies holding digital assets as strategic financial assets as more akin to “investment funds” than traditional firms, and thus proposes their exclusion from indices. MicroStrategy currently holds about 80% of its total assets in Bitcoin, far exceeding MSCI’s proposed 50% threshold.

MSCI will collect feedback until December 31 and announce its decision on January 15, 2026. Uncertainty remains, and based on past MSCI exclusion cases, there is a strong view that MicroStrategy could indeed be removed from the index.

Shift Toward Indirect Crypto Holdings via ETFs

Regardless of market sentiment, MSCI is setting new rules for listed companies regarding digital asset holdings. To avoid index exclusion, US-listed firms seeking large-scale crypto exposure may need to:

- Hold Bitcoin indirectly via exchange-traded funds (ETFs)

- Establish independent Bitcoin trusts or funds

- Limit direct holdings to below 49%

Within the crypto community, MSCI’s exclusion proposal and JP Morgan’s report are seen as a power struggle between traditional financial institutions and Digital Asset Treasury (DAT) firms—companies holding digital assets for treasury purposes. The core issue is not declining demand for crypto itself, but rather the method of holding these assets.

With Bitcoin down more than 30% from its peak, the market is clearly in a bearish phase. However, the pace of recovery will depend on whether the recent decline was driven by systemic risk and on future regulatory support for the crypto industry.

If MSCI does exclude MicroStrategy and similar DAT firms, passive funds will be forced to sell, putting downward pressure on both the affected companies’ share prices and Bitcoin. However, indirect corporate holdings via ETFs could increase as direct large-scale holdings are avoided.

Wave of Altcoin ETF Approvals

Despite the severe downturn, a series of altcoin ETF approvals in the US has gone largely unnoticed. The New York Stock Exchange (NYSE) approved spot ETFs for Dogecoin (DOGE) and Ripple (XRP) by asset manager Grayscale, with trading set to begin on November 25. On November 13, Canary Capital received the first approval for a spot Ripple ETF, which saw $58 million in trading volume on its debut—matching the strong interest seen in Solana ETFs. Other managers, including Franklin Templeton and WisdomTree, are preparing to launch Ripple ETFs, while Grayscale’s Chainlink (LINK) ETF is scheduled to list on December 2.

In September, the US Securities and Exchange Commission (SEC) approved general listing standards for crypto ETFs, streamlining the approval process for individual products. As a result, multiple ETFs have been approved despite US government shutdown concerns.

Following the approval of general listing standards, the US Treasury and Internal Revenue Service (IRS) issued new guidance on November 11 allowing crypto exchange-traded products (ETPs) to earn staking rewards and distribute them to retail investors. This enables ETP investors to benefit from staking yields.

Previously, uncertainty over whether ETPs participating in staking would lose their tax-advantaged trust status had delayed product launches. The new guidance removes this uncertainty. BlackRock, the world’s largest asset manager with $13.5 trillion in AUM, is also preparing to launch a staking Ethereum ETF.

On November 20, a bill was introduced in the US House of Representatives to allow federal taxes to be paid in Bitcoin. If passed, Bitcoin used for tax payments would be added to the national strategic reserve, and taxpayers would not incur capital gains tax.

Despite persistent systemic vulnerabilities—such as excessive leverage, forced liquidations by bots, and lack of oversight—the crypto market is seeing increased institutionalization. Numerous altcoin ETFs have been approved, traditional financial institutions are expanding into ETF and tokenization businesses, and governments are actively fostering the sector and introducing related legislation.

The current debate over MSCI’s potential exclusion of DAT firms will likely weigh on crypto prices in the near term. However, rather than structurally dampening demand for crypto assets, it is more likely to accelerate a shift toward indirect holdings via ETFs.

The crypto market has undergone numerous stress tests, and this episode is another such trial. As in the past, successfully navigating this phase could further solidify crypto’s status as a validated asset class and broaden its investor base.

(Mi-seon Lee, former Head of Research, Hashed Open Research)

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.