The US Stablecoin Bill (GENIUS Act) is expected to be introduced to the Senate floor as early as this week. If passed, the legislation would legally permit the issuance of stablecoins by authorized issuers in the United States, provided they meet requirements such as maintaining 100% reserves. The bill defines stablecoins as payment stablecoin digital assets, a move anticipated to significantly reduce legal risks related to securities regulations for issuers.

With bipartisan consensus on the need for the US to establish global regulatory standards and resolve industry uncertainty, the bill is seen as highly likely to pass both chambers of Congress. This development is expected to influence other countries' legislative efforts and accelerate global adoption of stablecoins.

Macroeconomic and Industry Structural Shifts

If the US stablecoin bill is enacted, the market capitalization of stablecoins is projected to expand to $1.6–2 trillion within the next 3–5 years, a six- to eightfold increase from the current $252.7 billion, according to Citi and Standard Chartered.

On the macroeconomic front, increased stablecoin issuance is expected to boost activity in the decentralized finance (DeFi) market, enhance market liquidity, and impact both crypto asset prices and inflation. The rise of DeFi, which is less susceptible to direct central bank control, could weaken the effectiveness of traditional monetary policy compared to the past.

From an industry perspective, the transition to a digital economy is likely to accelerate, with DeFi market growth and the advancement of the crypto ecosystem leading to the decentralization of functions such as lending, deposits, and foreign exchange—traditionally dominated by the conventional financial system—across multiple DeFi platforms.

Impact of Stablecoin Issuance on US Treasury Yields

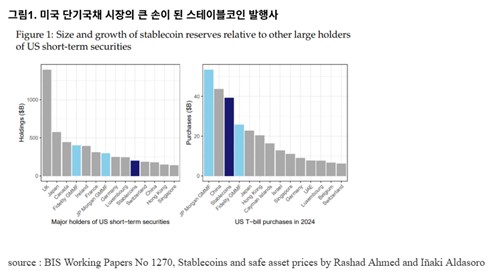

According to a Bank for International Settlements (BIS) report published in May, the volume of US short-term Treasuries held by dollar stablecoin issuers such as Tether (USDT) and Circle (USDC) now exceeds that held by China. In terms of net increases in US short-term Treasuries during 2024, stablecoin issuers ranked third after JPMorgan GMMF and China.

Under the bill, dollar stablecoin issuers must hold US dollars or US short-term Treasuries with maturities of 93 days or less on a one-to-one basis. As a result, increased issuance of dollar stablecoins will drive demand for US short-term Treasuries.

BIS analysis suggests that an inflow of $3.5 billion into the stablecoin market, requiring issuers to purchase an equivalent amount of US short-term Treasuries, would lower short-term US interest rates by approximately 3 basis points. Assuming a conservative annual stablecoin demand growth of 20%—necessitating equivalent Treasury purchases—short-term rates could be reduced by 43 basis points (20% of the current $252.7 billion market cap equals $50.5 billion).

Conversely, if issuers were to sell $3.5 billion in short-term Treasuries, short-term rates could rise by 6–8 basis points, as such sales are likely to occur more rapidly than purchases.

In summary, the growth of the stablecoin market is expected to initially boost demand for US short-term Treasuries and help stabilize short-term rates, but it also introduces potential risks of heightened volatility.

Stablecoin Issuance and the Monetary Multiplier Effect

Passage of the stablecoin bill will naturally lead to increased stablecoin issuance. Aside from some cases where dollar stablecoins are used as substitutes for local currencies, their primary use remains in DeFi markets for activities such as deposits, lending, and crypto asset trading.

Leverage in DeFi differs from traditional bank credit creation in that it operates without third-party oversight. While bank lending is subject to government controls such as interest rate policy and regulatory guidance, DeFi market rates are determined by user demand for deposits and loans. As long as collateral is provided, loans can be extended regardless of credit rating or income, placing such activities outside the purview of regulators.

For example, a user who purchases Ethereum (ETH) with dollar stablecoins can stake ETH on the Lido platform to receive stETH, then use stETH as collateral on DeFi lending platforms like AAVE to borrow more stablecoins such as USDC. By repeating this process—purchasing additional ETH, staking, and borrowing—the monetary multiplier can reach up to approximately 3.3 times (3.3 ≒ 1/(1-0.7)), based on a 70% collateral value ratio.

While such lending activities have been possible prior to the bill, increased issuance of reliable stablecoins following its passage would further activate the DeFi market, boosting liquidity within the crypto ecosystem. This is likely to drive crypto asset prices higher in the short term and could indirectly channel some liquidity into the real economy.

To restrict this, regulators would need to impose direct sanctions on the DeFi market, which is considered practically unfeasible. Alternatively, tightening dollar liquidity to slow new stablecoin issuance would impose significant pain on the real economy, making it a costly approach. Ultimately, traditional monetary policy tools may prove inadequate to control the liquidity effects arising from DeFi-based lending, re-lending, and tokenized asset restaking. The fundamental reason for this shift is the decentralization of credit creation authority across numerous DeFi platforms.

Investors should understand these mechanisms and consider reallocating assets to increase long-term exposure to crypto markets where new liquidity can be supplied.

Anticipated Competition in Dollar Stablecoin Issuance

The US stablecoin bill marks the first attempt to recognize crypto assets as payment instruments and integrate them into the financial system. US banks already comply with many of the regulatory requirements stipulated by the bill and are prepared to meet additional anti-money laundering and other obligations. As a result, US banks are expected to actively pursue stablecoin issuance and related investments following the bill's passage.

Beyond issuance, US banks are likely to seek business opportunities across the entire ecosystem, including permitting stablecoin payments for loans and financial product transactions, and advancing tokenization of financial products.

Demand to Concentrate on Competitive Stablecoins

As competition intensifies among existing issuers, new entrant banks, and non-bank institutions for dollar stablecoin issuance in the US, countries like South Korea will face growing concerns over protecting monetary sovereignty amid the strengthening position of dollar stablecoins. Given the borderless nature of crypto asset transfers, demand will concentrate on stablecoins that are versatile, highly compatible, and user-friendly. South Korea must swiftly establish a regulatory framework to enable the issuance and circulation of competitive stablecoins in line with these global trends.

(Mi-seon Lee, former Head of Research at Hashed Open Research)

jsjeong@yna.co.kr

(End)

© Yonhap Infomax. Unauthorized reproduction and redistribution, as well as AI training and utilization, are prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.