(Seoul=Yonhap Infomax) Jin Woo Oh – South Korean government bond futures opened slightly higher on the morning of the 25th.

The domestic bond market tracked gains in U.S. Treasuries, as U.S. Treasury yields continued to decline.

However, with the Bank of Korea’s Monetary Policy Board meeting just one day away, investor sentiment remains cautious.

According to the Seoul bond market, as of 08:57 KST, the 3-year government bond futures were quoted at 105.85, up 2 ticks from the previous session.

Foreign investors were net sellers of 750 contracts, while banks were net buyers of 600 contracts.

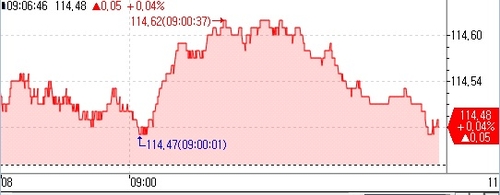

The 10-year government bond futures rose 8 ticks to 114.51.

Foreign investors bought 240 contracts, while securities firms sold 270 contracts.

U.S. Treasury yields extended their decline following reports that Kevin Hassett, a noted policy dove and White House National Economic Council (NEC) member, is a leading candidate for the next Federal Reserve chair.

Overnight, the U.S. 2-year Treasury yield fell 3 basis points, while the 10-year yield dropped 2.9 basis points.

“With the likelihood of a Fed rate cut in December becoming clearer, the domestic bond market is also strengthening,” said a dealer at a securities firm. “However, as the Bank of Korea may signal a shift away from a rate-cutting stance in its policy statement on the 27th, it is a difficult time for aggressive positioning.”

He added, “We do not expect the Bank of Korea to be hawkish enough to completely rule out the possibility of a rate cut.”

jwoh@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.