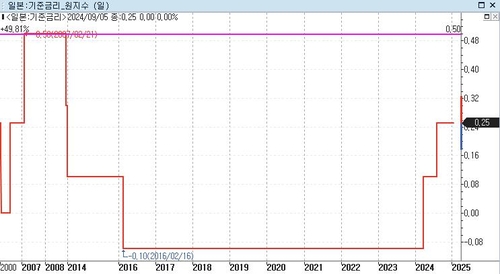

Largest increase in 17 years since 2008

(Seoul=Yonhap Infomax) Su Sie Kang = The Bank of Japan (BOJ) is expected to raise its benchmark interest rate by 25 basis points at its monetary policy meeting on January 24, marking the highest policy rate in 17 years. This move is seen as demonstrating confidence in the sustainability of inflation, a key factor in interest rate normalization.

According to Yonhap Infomax's country-specific policy rates (screen number 8844) on January 23, the BOJ, which will hold a two-day meeting starting today, is anticipated to increase its overnight call rate to 0.5%, a 25bp hike. This would be the first rate hike in about six months since August last year and the highest rate since October 2008.

BOJ Governor Kazuo Ueda had previously identified wage negotiations in Japan and policy outlook of the new U.S. administration as key factors in deciding on a rate hike last month.

Currently in Japan, the spring wage negotiations known as "Shunto" began on January 22. It has been reported that Masakazu Tokura, chairman of Keidanren (Japan Business Federation), and Tomoko Yoshino, chairperson of Rengo (Japanese Trade Union Confederation), have reached a consensus on wage increases.

Additionally, the lack of significant market shocks following U.S. President Donald Trump's inauguration on January 20 is another factor suggesting a potential BOJ rate hike.

Governor Ueda emphasized on January 15 and 16 that if economic and price conditions continue to improve, the BOJ would raise interest rates this year.

He explained, "The approach to monetary policy adjustment varies depending on the economic, price, and financial conditions at the time," adding, "We will discuss whether to raise interest rates based on new quarterly growth and inflation forecasts next week."

Overnight index swap traders have fully priced in the possibility of a rate hike this month.

A CNBC survey also showed that 18 out of 19 economists agreed on the likelihood of a rate increase.

Experts have left open the possibility that Governor Ueda may comment on further rate hikes. They are particularly focused on whether he will revise his statement that real interest rates remain at a "considerably" low level. These analysts anticipate the terminal rate for this BOJ rate hike cycle to be 1.0%.

Another point of interest is whether the inflation forecast will be revised upward in the economic outlook report to be released this time. An upward revision in the price forecast would indicate confidence in sustained inflation.

The BOJ policy decision statement and quarterly economic outlook report are typically released around noon, followed by Governor Ueda's press conference at 3:30 PM.

sskang@yna.co.kr

(End)

<Copyright© Yonhap Infomax, Unauthorized reproduction and redistribution prohibited, AI learning and utilization prohibited>

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.