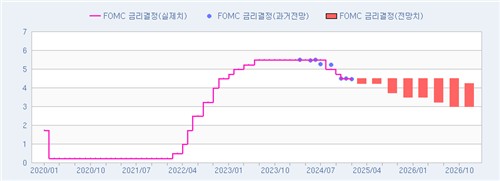

(Seoul=Yonhap Infomax) Yun Gu Lee = The U.S. Federal Reserve is expected to hold interest rates steady at its upcoming Federal Open Market Committee (FOMC) meeting scheduled for January 28-29 (local time). At the first FOMC meeting since Donald Trump's inauguration, there is a tendency to focus on moderating the pace due to increased uncertainty. The prevailing view is that the Fed will maintain the hold trend and then proceed with one rate cut within the first half of the year. However, President Trump's direct pressure on the Fed for rate cuts is acting as a variable.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.