(Seoul=Yonhap Infomax) Youn Gyo Jung = Spot prices for memory DRAM, considered a leading indicator for the semiconductor market, have shown a slight increase at the start of the new year.

After five consecutive months of decline in the latter half of last year, memory DRAM spot prices halted their downward trend in January and rebounded slightly. However, analysts predict that the semiconductor industry will still face challenges this year.

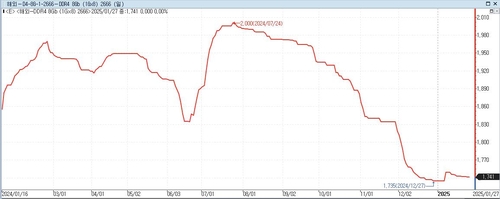

According to Yonhap Infomax semiconductor prices (screen number 6536) and market research firm DRAMeXchange on the 2nd, the price of the mainstream DRAM product DDR4 8G(1Gx8) 2666 was $1.741 based on the closing price on January 27.

The price increased by about 0.34% over the month of January. This slight rebound follows a sharp decline of about 4.56% in the previous month.

The price of DDR4 8G(1Gx8) 2666 had risen to $1.969 at the end of February last year due to IT demand recovery, then showed a slight weakening before rebounding from mid-June. It even reached $2 at the end of July but turned downward from August.

DRAM spot prices refer to temporary transaction prices between dealers and consumers. While they don't account for a large portion of the overall DRAM market, they are significant as they reflect immediate market sentiment.

The spot price for DDR3 4Gb 512Mx8 1600/1866, the cheapest product group, was $0.77 as of January 27, down $0.01 from $0.78 a month earlier.

The spot price for DDR3 4Gb 512Mx8 1600/1866 has shown a steady downward trend over the past year.

The fixed transaction price for DRAM futures remained steady.

The average fixed transaction price for the general-purpose DRAM product DDR4 8Gb (1Gx8) last month was $1.35, maintaining the same level for the third consecutive month since November last year.

DRAM fixed transaction prices had continued to rise in the first half of last year, surpassing $2 in April for the first time since December 2022.

The DRAM fixed price, which had maintained $2.1 from April to July last year, only slightly decreased to $2.05 in August, but then plummeted to $1.7 in September and has remained at $1.35 since November.

NAND fixed transaction prices showed a slight rebound.

The average fixed transaction price for the general-purpose NAND flash product 128Gb 16Gx8 MLC for memory cards and USB in December was $2.17, up 4.32% from $2.08 the previous month.

Prices had plunged 29% month-on-month in both October and November last year, followed by an additional 3.25% retreat in December.

While the steep decline in DRAM prices seems to have stabilized at the start of the new year, positive voices are still not heard in the semiconductor industry. Most forecasts suggest that the semiconductor market, including DRAM and NAND, will remain sluggish.

TrendForce, a Taiwanese market research firm, estimates that DRAM prices will fall by 8-13% in the first quarter of this year.

They analyzed that the downward trend in DRAM prices will gain momentum due to not only the existing demand slowdown but also customers adopting more conservative purchasing strategies with the inauguration of Donald Trump's second administration, coupled with the seasonal off-season.

TrendForce predicted that "Even including high-value-added products like HBM, the price decline will only be reduced to 0-5%, but it will be difficult for the downward trend to turn into an upward one."

The NAND flash industry is expected to face double pressure from weak demand and oversupply this year.

Analysts suggest that product shipments for smartphones and laptops continue to be sluggish due to increased domestic and international uncertainties, and even the enterprise solid-state drive (SSD) market, which had been relatively robust, is seeing its growth slow down due to reduced IT investment.

ygjung@yna.co.kr (End)<Copyright© Yonhap Infomax, Unauthorized reproduction and redistribution prohibited, AI learning and utilization prohibited>

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.