Recent trends show apartment prices are entering a full-fledged decline. Not only in provincial areas but also in the metropolitan area excluding Seoul, apartment prices have fallen. If this trend continues, even Seoul apartment transaction prices are expected to turn downward. However, market participants are anticipating that if banks resume mortgage loans and the Bank of Korea lowers its key interest rate, prices will rebound. Let's examine whether changes in financial conditions can revive the apartment market with Nam Seung-pyo, a reporter from the Industry Department.

[Anchor] What's the current situation in the housing market?

[Nam Seung-pyo Reporter] I'll explain the market situation based on the recent real transaction price report from the Korea Real Estate Board. The real transaction price index report is released about two months in arrears, so the latest report came out on January 15th, reflecting the real transaction trends from last November.

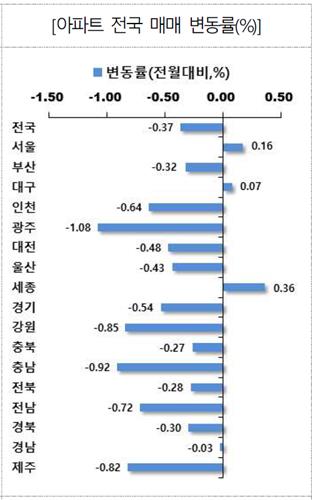

Nationwide apartment sale prices fell by 0.37% compared to the previous month. Among metropolitan cities and provinces nationwide, only three areas saw increases compared to the previous month: Seoul by 0.16%, Daegu by 0.07%, and Sejong by 0.36%. The largest decline was in Gwangju, falling by 1.08%, followed by South Chungcheong Province at 0.92%, and Jeju at 0.82%, showing significant drops. The metropolitan area also saw declines, with Gyeonggi Province down 0.54% and Incheon down 0.64%.

The change in jeonse (long-term deposit rent) prices differed somewhat from sale prices. Nationwide, it rose by 0.04%, the metropolitan area by 0.06%, while provincial areas fell by 0.02%. However, Seoul apartment jeonse prices fell by 0.24% compared to the previous month, while Incheon and Gyeonggi Province rose by 0.12% and 0.31% respectively.

In the metropolitan area, all areas except Seoul declined, and Seoul is expected to join the downward trend soon. The real transaction report includes a tentative index change rate for next month's transactions, which predicts Seoul will fall by 0.51%. This is because the central area, including Jongno, Yongsan, and Jung-gu, is expected to fall by 1.18%, and the northeastern area, including Gangbuk, Dobong, Nowon, Seongbuk, Dongdaemun, Jungnang, Seongdong, and Gwangjin-gu, is predicted to fall by 0.94%. The southeastern area, including the three Gangnam districts, which rose by 0.83% in November, is expected to fall by 0.18% in December. The northwestern area, including Eunpyeong, Seodaemun, and Mapo-gu, is also expected to decline by 0.91% according to the tentative index.

[Anchor] How about transactions?

[Reporter] Transaction volume is also not good. Nationwide apartment transactions in November were recorded at 27,470 units, down 17.3% from the previous month. By region, the metropolitan area saw 10,983 transactions and provincial areas 16,487, decreasing by 18.6% and 16.4% respectively compared to the previous month. However, compared to the same month last year, it might seem better, but considering that housing transactions were significantly contracted in the second half of 2022 due to the impact of interest rate hikes, it's difficult to assign much significance to this comparison.

[Anchor] With both transactions and prices declining, it seems the apartment market is entering a quite difficult phase. But there are views expecting the market to revive if the Bank of Korea lowers the key interest rate and banks resume lending within this year's loan limits. What do you think about this?

[Reporter] Yes, if we look at when Seoul apartment transaction volume started to decline last year, it coincides with when financial authorities implemented the second phase of the Debt Service Ratio (DSR) measure. Therefore, even non-experts might think that when loan regulations are tightened, apartment prices fall, and when they are eased, prices rise.

But there are a few things to consider. Why did this happen? There are mainly two sources of purchasing power for apartments: income and loans. Income can be divided into regular income earned periodically and non-regular income from selling houses or stocks. However, current house prices have become too far out of reach for income alone.

There's a statistic provided by KB Real Estate called the KB Apartment Mortgage Loan PIR. It divides the price of the house being borrowed against by the annual income of the borrower. As of September last year, it was 11 for Seoul, 9 for Gyeonggi, and 8 for Incheon. This means that for a Seoul apartment, one would need to save every penny of their annual income for 11 years to be able to buy it. Since the typical appropriate housing expenditure ratio from income is considered to be around 30%, in reality, it would take 33 years of saving to buy a house in Seoul. If we assume the employment age for young people is 30, it means they would be 63 before they could afford their own home with income alone, which is practically impossible.

[Anchor] So that's why people rely on loans.

[Reporter] That's right. The recent pattern of prices rising when mortgage loans increase and prices stagnating or falling when mortgage loans are restricted can be seen as a result of house prices being too high compared to income.

[Anchor] Then financial conditions will determine housing purchasing power. What's the financial policy direction for this year?

[Reporter] First, let's look at the banks' stance on lending. There's a survey conducted by the Bank of Korea called the Financial Institution Lending Behavior Survey. It targets 203 financial institutions including banks and savings banks, and the most recent survey was released on the 15th of last month, covering the fourth quarter of last year and the outlook for the first quarter of this year.

According to this data, domestic banks' lending attitude towards households is expected to ease somewhat in the first quarter of this year. The lending attitude towards household housing was very strict in the third and fourth quarters of last year, with -22 and -42 respectively. However, for the first quarter of this year, it came out as +6, interpreted as easing. Banks also expected household housing loan demand to increase significantly, from 28 in the third quarter of last year and 9 in the fourth quarter to 19 in the first quarter of this year.

The problem lies with financial authorities. Financial Services Commission Chairman Kim Byoung-hwan stated that this year's household debt growth rate would be managed within the range of nominal GDP growth, which is 3.8%. Last year's nominal GDP growth was 5.9%, but the forecast presented by the Ministry of Economy and Finance at the beginning of the year was 4.9%. Based on the forecast, this year's loan growth is set to decrease by more than 1%. This means that even if there's willingness to lend at the counter, there are limitations.

There's one more thing to consider. The reduced lending capacity might be swept up by the so-called "solid single units" in Seoul and the metropolitan area. For example, the Olympic Park Foreon in Seoul's Gangdong-gu, which is currently being moved into, is estimated to require loan demand of 6 to 8 trillion won to pay the balance, although the exact figure is not known.

According to the Financial Services Commission, the net increase in mortgage loans from the financial sector last year was 57.1 trillion won. However, considering that this year's nominal GDP growth is expected to decrease by about 20% compared to last year, it will be difficult for bank loans to increase by more than 46 trillion won this year. If more than 10% of this amount is taken by a single complex, it could become relatively more difficult for other areas to get loans compared to last year.

[Anchor] What about the impact on prices?

[Reporter] We need to reconsider the Financial Services Commission's statement about managing household loan growth below nominal GDP growth. If this year's loan growth rate decreases compared to last year, it will be difficult to support price increases because the funds flowing into the housing market itself will decrease. Of course, you might say that solid single units are different, but the term "solid single unit" means that demand for housing overall is shrinking. It's questionable whether we can assign significance to a small number of houses being traded at high prices when the overall market is declining.

The same goes for lowering the key interest rate. Lowering the key rate does reduce the loan burden. However, the reason for lowering the key rate is important. It's because of concerns about economic recession. An economic recession means a situation where income is decreasing. We need to look at both the increase in loan capacity due to interest rate cuts and the decrease in income due to economic recession.

Moreover, mortgage loans are calculated including an additional rate on top of the key rate. The government is limiting the total amount of loans by raising the stress interest rate to prevent funds from flooding into the real estate market due to key rate cuts. Financial institutions are also likely to maintain the actual loan interest rate unchanged by raising the additional rate applied to mortgage loans. Therefore, even if the Bank of Korea lowers the key rate, it's dangerous to mechanically associate this with house price increases.

(Yonhap Infomax Industry Department Reporter Nam Seung-pyo)

※This content is from the video news covered in the Yonhap News TV's Investigation File corner.

spnam@yna.co.kr

(End)

<Copyright© Yonhap Infomax, Unauthorized reproduction and redistribution prohibited, AI learning and utilization prohibited>

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.