(Seoul=Yonhap Infomax) Si Yoon Yoon = The Infomax Panic-Boom indicator, which had shown stability recently, is displaying signs of unease once again.

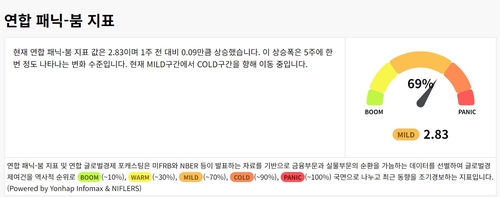

According to the Infomax Panic-Boom Cycle (screen number 8283) on the 13th, the Infomax Panic-Boom indicator, which gauges the level of global economic activity, rose by 0.09 points to 2.83 out of 5 compared to a week ago.

A higher score indicates a closer proximity to recession. While the indicator had been steadily improving since the beginning of the year, it has recently shown a partial reversal. The trend is moving from the 'MILD' zone towards the 'COLD' zone.

The possibility of an economic downturn within a year has also increased.

Looking at the leading economic indicator, the 'Infomax Global Economic Forecasting' index, the likelihood of a global economic recession occurring within the next year is about 32.3%, up 12.4 percentage points compared to a month ago. In terms of zones, it is moving from 'COLD' to 'PANIC'.

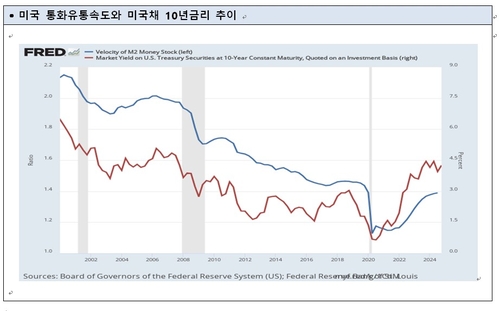

Professor Ki-tae Yang of Soongsil University Graduate School of Business, who previously served as an EY partner and Standard & Poor's (S&P) director, noted the recent upward trend in 'money velocity' and viewed that macroeconomic variables are stabilizing.

However, concerns were also raised that excessive volatility could trigger a decline in the prices of risk assets.

According to Professor Yang's analysis, money velocity has been continuously rising since recording its lowest level in 60 years at 1.1 times in the second quarter of 2020. It is currently around 1.4 times in the fourth quarter of 2024, which is similar to pre-COVID levels.

He stated, "The upward trend in money velocity could mean that the economy might be moving from a 'bubble economy' to a 'productive economy', and macroeconomic variables in the recent Infomax Panic-Boom indicator have also stabilized a bit more." However, he added, "Because money velocity became too low due to prolonged low interest rates after the 2008 global financial crisis, the current rise in money velocity could also cause a liquidity shock."

Professor Yang also pointed out that the recent growth rate of money supply (M2) is recording 3.9% and is rising towards 6.0%, which is considered the 'trigger' level for inflation materialization.

He continued, "Looking at this M2 growth rate, the number of interest rate cuts by the U.S. Federal Reserve (Fed) could be fewer than expected." He added, "However, considering the increasing trend of U.S. money velocity, it is expected that the rise in long-term U.S. Treasury yields will continue rather than short-term yields."

Meanwhile, the U.S. stock uncertainty index fell by 19.33 to 141.89 compared to a week ago. This is a level of change that occurs about once every two weeks, moving from the 'PANIC' zone to the 'COLD' zone.

The effective interest rate on U.S. high-risk bonds decreased by 0.01 percentage points to 11.3% compared to a week ago. In terms of zones, it is moving from 'MILD' towards 'WARM'.

The U.S. corporate credit growth rate fell by 0.47 percentage points to 1% compared to a week ago. This is a decline that occurs about once every three weeks, moving from the 'COLD' zone to 'PANIC'.

The difference between long-term and short-term interest rates in the U.S., a sub-index of the Panic-Boom indicator, decreased by 0.02 percentage points to 0.24 percentage points compared to a week ago. It is moving from the 'COLD' zone towards 'MILD'.

Professor Yang explained, "The possibility of the long-short term interest rate spread, which has been inverted for a long time, continuously rising in the positive territory is increasing." He added, "This could lead to a forecast of a potential liquidity shock in the U.S. during the first half of 2025."

He further stated, "Typically, the negative effects of M2 growth rate materialize after about 24 months, so the first half of this year should be approached cautiously from a risk perspective." He also added, "While the U.S. did not enter a recession in the late 1990s, there is a possibility of entering a recession when the inverted long-short term interest rate spread normalizes."

syyoon@yna.co.kr

(End)

<Copyright© Yonhap Infomax, Unauthorized reproduction and redistribution prohibited, AI learning and utilization prohibited>

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.