(Seoul=Yonhap Infomax) Su Sie Kang = Since Donald Trump's re-inauguration as US President in January, the US stock market has shown divergent performance across sectors.

In January, immediately after the re-inauguration, most sectors showed an upward trend, with the Standard & Poor's (S&P) 500 index reaching an all-time high. However, since February, as the Trump administration's second-term policies began to unfold and uncertainties increased, the index movement has remained relatively flat.

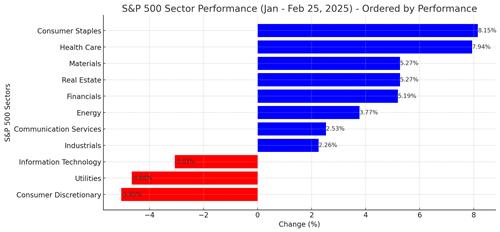

On the 27th, an analysis using the generative AI ChatGPT-4o on Yonhap Infomax's sector-specific index comparison (screen number 6527) revealed that among the 11 S&P sector indices, cyclical stocks such as financials and energy showed relative strength, while technology stocks unexpectedly underperformed.

Conversely, the healthcare sector, which was expected to underperform under the Trump administration, showed the most prominent rise.

◇ Unexpected Strong Performance: Consumer Staples, Healthcare, Materials, Real Estate

Among the 11 S&P sector indices, consumer staples showed the strongest performance from the beginning of the year until the 25th, with the highest increase of 8.15%.

Consumer staples are often perceived as defensive stocks, as they guarantee steady demand even in situations of increased economic uncertainty and weakened consumer sentiment. However, with the increased preference for risk assets in the early days of the Trump administration, demand for defensive stocks was not significant. Furthermore, future negative impacts are anticipated due to rising import costs from widespread tariff impositions.

The second-best performing sector was, surprisingly, healthcare, with a 7.94% increase. Healthcare was expected to face heightened volatility due to policy uncertainties, but instead benefited from the possibility of relaxed drug price control policies compared to the Biden administration.

The financial sector rose 6.4% in January, leading the market rally alongside healthcare. A notable feature was the strong surge in bank stocks due to expectations of financial deregulation and corporate tax cuts following Trump's re-election. However, entering February, the rise in financial stocks partially moderated as market volatility increased due to tariff issues. Nevertheless, the financial sector was expected to continue enjoying a favorable environment throughout the term.

Additionally, stocks related to industrials, building materials, defense industries, and energy saw sharp rises due to Trump's promises of infrastructure investment, increased defense spending, and expanded energy production.

◇ Too Much Growth? Tech Sector Led by AI Shows Unique Weakness

The information technology (IT) sector index, which had led the US stock market rally for the past two years, fell over 3% this year, showing relatively poor performance.

As President Trump's tariff targets were mainly focused on the technology industry, including semiconductors and electronic products, concerns over disruptions in the global IT supply chain grew. Moreover, the emergence of China's low-cost AI DeepSeek shocked big tech stock prices, leading to an overall adjustment in the technology sector at the beginning of the year.

The Philadelphia Semiconductor Sector Index (USI:SOXX) rose only 0.72% in January, essentially remaining flat, and has fallen over 2.5% so far this month.

In the short term, the volatility of tech stocks may increase depending on future policy directions, given the mixed situation of favorable conditions such as Trump's corporate tax cut promises.

However, as the market recovers from the temporary DeepSeek shock and the investment environment improves in the long term due to tax cuts and deregulation, leading to more aggressive research and development and new business ventures, the technology sector is likely to regain investors' attention.

◇ How Was Trump's First Term? S&P500 Up 68%, Tech Stocks Up 180%

During President Trump's first term from 2016 to 2020, there were also clear differences in stock price trends across sectors.

From immediately after the November 2016 election to November 2020, the S&P 500 rose about 68.5%, while the technology sector surged by about 180% during the same period, recording the highest increase.

This was followed by consumer discretionary up 86.7%, healthcare up 53.6%, materials up 40.3%, and industrials up 37.8%, with most sectors showing significant gains.

Meanwhile, financial stocks rose only 24.3%, initially benefiting from tax cut effects early in the term but later limited by the US-China trade dispute and interest rate fluctuations. Communication services, consumer staples, and real estate also saw limited gains of around 20% due to their defensive nature and regulatory risks.

The energy sector was the only one to record a large decline of -57.4% at the time. Despite the Trump administration's pro-energy policies, the sector suffered severe underperformance due to falling oil prices in the late 2010s and the sharp drop in demand during the early 2020 pandemic.

sskang@yna.co.kr (End)<Copyright (c) Yonhap Infomax, Unauthorized reproduction and redistribution prohibited, AI learning and utilization prohibited>

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.