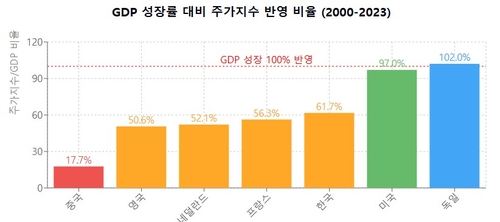

(Seoul=Yonhap Infomax) Kyu Sun Lee = While there are concerns that South Korea's KOSPI growth rate is not keeping pace with its GDP growth, similar trends are evident in major European countries such as France and the Netherlands. The divergence between KOSPI and GDP is attributed not simply to a "Korea Discount" phenomenon, but fundamentally to a lack of innovation across the market. On the 6th, Yonhap Infomax analyzed nominal GDP growth rates and stock index data for major countries from 2000 to 2023. The results showed that China, the UK, the Netherlands, and France all had larger gaps between GDP and stock indices than South Korea, while only the US and Germany demonstrated meaningful correlation.

◇ KOSPI rose 2.19 times while GDP grew 3.5 times... China, France, UK show more severe divergence

The phenomenon of stock markets failing to properly reflect economic growth rates has emerged as a global trend.

The order of countries with large divergences was: ▲China ▲UK ▲Netherlands ▲France ▲South Korea ▲US ▲Germany (stock price growth rate exceeding GDP growth rate).

China's GDP grew 12.78 times from 1.013 trillion yuan in 2000 to 12.9427 trillion yuan in 2023, but the Shanghai Composite Index (SSE) only rose 2.26 times from 1,368.69 to 3,087.51 during the same period, accounting for only about 20% of GDP growth.

The UK's GDP increased 2.47 times, but the FTSE 100 only grew 1.25 times, showing a 98% divergence. The Netherlands (GDP 2.36 times, AEX 1.23 times) and France (GDP 1.92 times, CAC 40 1.08 times) also showed underperforming stock markets.

South Korea's GDP grew 3.55 times, but KOSPI only rose 2.19 times, showing a 62% divergence.

In contrast, the US showed a close correlation with only a 3% difference between GDP (2.70 times) and S&P 500 (2.62 times) growth. Germany's DAX40 index rose 2.01 times while its GDP increased 1.97 times, with the stock index growth rate surpassing GDP growth.

◇ Governance improvement necessary, but 'innovation' is key

Experts point to the lack of industrial innovation, rather than corporate governance, as the root cause of stock markets failing to keep pace with GDP growth rates.

Professor Dong-Hyun Ahn of Seoul National University's Department of Economics said, "Advanced countries like the Netherlands, UK, and France also have undervalued stock indices compared to economic growth rates," indicating that improving governance alone is not enough to boost stock indices.

He explained, "The US leads technological innovation with capital markets centered on direct financing supporting venture investments, while Europe's innovation environment for companies is weak due to loan-oriented funding." He diagnosed, "The fundamental cause of South Korea's stock index underperformance is the failure to foster new industries and transition to high value-added industries."

Professor Ahn added, "Companies with high productivity and innovation need to emerge," and "Stock prices will rise when the top 10 company rankings circulate."

Bank of Korea Governor Changyong Rhee has also emphasized the need for innovative companies to emerge for growth. In his New Year's address this year, he pointed out, "In the US, 7 out of the top 15 companies by sales over the past 10 years were new entrants, while in Korea, only 2 changed, and only 1 of those was based on new industries," indicating a lack of Schumpeterian "creative destruction" and the absence of new growth engines.

However, improving corporate governance is also expected to play a positive role in stock price appreciation.

According to a study (The Korea Discount and Chaebols) by Professor Romain Ducret analyzing 25,863 companies from 28 countries from 2002 to 2016, Korean companies' price-to-earnings (P/E) ratios were on average 30% lower than companies in other countries. Contrary to common belief, Professor Ducret found that the discount rate for chaebol affiliates (14.31%) was lower than that of non-chaebol companies (26.43%).

He also explained that the discount gap is gradually narrowing, and improvements in corporate governance and the introduction of holding company systems have contributed to resolving the discount.

kslee2@yna.co.kr (End)<Copyright© Yonhap Infomax, Unauthorized reproduction and redistribution prohibited, AI learning and utilization prohibited>

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.