(Seoul=Yonhap Infomax) Jong Hwa Han – Real estate consumer sentiment in the Seoul metropolitan area shifted from neutral to positive in October, according to a survey of real estate brokerages.

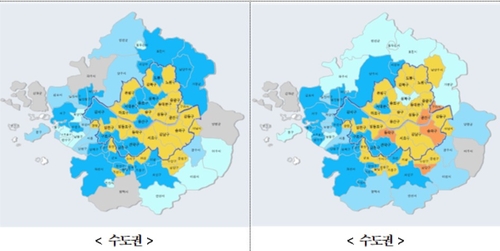

The Korea Research Institute for Human Settlements (KRIHS) announced on the 17th that its October Real Estate Market Consumer Sentiment Index stood at 112.0 nationwide, 115.9 in the Seoul metropolitan area, and 107.2 in non-capital regions.

While the nationwide and non-capital region indices rose by 2.9 points and 1.8 points respectively, both remained in a neutral phase. The Seoul metropolitan area index climbed 3.7 points, moving from neutral to an upward phase.

Seoul maintained its upward momentum, rising from 120.3 in September to 123.4 in October, a 3.1-point increase.

The Real Estate Market Consumer Sentiment Index is classified as follows: below 95 indicates a bearish market, 95–115 is neutral, and above 115 signals an upward trend.

Regions with the largest increases in sentiment included Sejong (+5.4 points), Gyeonggi (+4.1 points), and Jeonnam (+3.8 points). Sejong shifted from neutral to upward in October, while Gyeonggi and Jeonnam remained neutral.

Major declines were observed in Ulsan (-3.4 points), Chungnam (-2.5 points), and Jeju (-0.1 points). Ulsan remained in an upward phase, while Chungnam and Jeju stayed neutral.

The combined consumer sentiment index for home sales and jeonse (long-term lease unique to Korea) was 114.9 nationwide, 119.0 in the Seoul metropolitan area, and 109.9 in non-capital regions.

Compared to the previous month, the indices rose by 3.0 points nationwide, 4.2 points in the Seoul metropolitan area, and 1.9 points in non-capital regions. The Seoul metropolitan area shifted from neutral to upward, while the nationwide and non-capital indices remained neutral.

The home sales market sentiment index rose 3.3 points to 120.8 nationwide and 5.3 points to 127.0 in the Seoul metropolitan area. The non-capital region increased by 1.2 points to 113.2.

Except for the non-capital region, which remained neutral, both the nationwide and Seoul metropolitan area indices continued in an upward phase.

The largest increases in the home sales market sentiment index were seen in Incheon (+6.6 points), Gyeonggi (+5.7 points), and Chungbuk (+5.5 points).

Seoul recorded the highest home sales market sentiment index at 137.5, up 4.1 points from the previous month.

The jeonse market sentiment index remained neutral at 109.0 nationwide, 110.9 in the Seoul metropolitan area, and 106.5 in non-capital regions.

Last month, the government announced its October 15 real estate policy package.

According to the KRIHS survey of real estate brokerages, the proportion of respondents in the Seoul metropolitan area reporting an increase in home buyers (sum of "much more" and "somewhat more") rose from 14.6% in September to 19.7% in October. In Seoul, the figure increased from 26.5% to 31.5%.

Lee Eun-hyung, a research fellow at the Korea Institute of Construction Policy, commented, "It is too early to attribute the increase in purchase responses solely to the October 15 policy, as only a month has passed since its announcement," but added, "It likely had some impact."

Lee further noted, "There have been instances in the past where housing prices rose following new regulations. In a market already experiencing price increases, the announcement of new restrictions may have spurred additional buying demand."

The survey also partially supported expectations that tighter mortgage lending restrictions following the October 15 measures would drive up demand for jeonse leases.

The proportion of brokerages in the Seoul metropolitan area reporting increased demand for jeonse leases rose from 46.6% in September to 48.7% in October, and in Seoul from 45.7% to 50.3%.

Lee explained, "The core of the new regulations is tighter lending. As buyers are unable to secure mortgages, they have little choice but to turn to jeonse leases, indicating the October 15 measures are influencing the market."

jhhan@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.