(Seoul=Yonhap Infomax) Sun Young Jung—The dollar-won exchange rate approached the 1,470-won mark in morning trading.

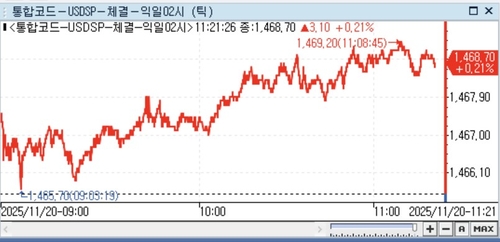

As of 11:15 a.m. KST on the 20th, the dollar-won rate was trading at 1,468.90, up 3.30 won from the previous session.

The session opened at 1,467.40, 1.80 won higher than the previous day's 15:30 close. The greenback steadily climbed into the 1,469-won range during the morning session.

Despite a rally in South Korea's benchmark KOSPI index—up more than 2.6% on strong earnings from Nvidia—selling pressure on the dollar remained limited. Foreign investors net bought 424.9 billion won ($310 million) in KOSPI-listed stocks.

However, the dollar gained upward momentum as the dollar-yen rate rose to the 157-yen level in morning trading. The weakening yen also pressured the won, supporting the dollar-won rate.

The U.S. Dollar Index climbed above the 100 mark, further contributing to the dollar's strength.

Market participants are closely watching dollar demand related to Samsung Electronics Co.'s dividend payout to foreign investors, which was distributed the previous day. The dividend payout amounts to approximately $920 million, with outflows expected to occur over two days following the payment date.

Separately, Samsung Heavy Industries Co. announced it had secured an order for seven container ships worth 1.922 trillion won ($1.4 billion).

The Chinese yuan depreciated, with the People's Bank of China (PBOC) setting the midpoint at 7.0905 yuan per dollar, a 0.05% weakening.

Afternoon Outlook

FX dealers expect the dollar-won rate to test the 1,470-won level in the afternoon session.

“The rate will likely rise to levels where there is caution, possibly touching the 1,470-won range amid the strong dollar trend,” said a bank FX dealer. “However, with ample supply in the market at the open and some export-related selling, as well as news of new orders, the upside may be capped.”

Another dealer noted, “Risk appetite seems to have little impact. With the won remaining weak, the dollar-won rate could test levels that might prompt verbal intervention.” He added, “Settlement demand continues to flow in, and while Samsung Electronics’ dividend payout has not had a major market impact in the past, it could have some effect this time.”

Intraday Trends

The dollar-won rate opened higher, tracking gains in the New York non-deliverable forward (NDF) one-month contract. During the session, the high was 1,469.20 and the low was 1,465.70. According to Yonhap Infomax data (screen no. 2139), trading volume stood at approximately $3.9 billion as of the current time.

The dollar-yen rate was quoted at 157.40 yen, up 0.43 yen from the New York session, while the euro-dollar rate was at $1.1510, down 0.0007. The yen-won cross rate was 933.11 won per 100 yen, and the yuan-won rate was 206.32 won. The offshore dollar-yuan (CNH) rate rose to 7.1194 yuan.

syjung@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.