(Seoul=Yonhap Infomax) Sun Young Jung = The dollar-won exchange rate briefly touched the 1,470 won mark during intraday trading.

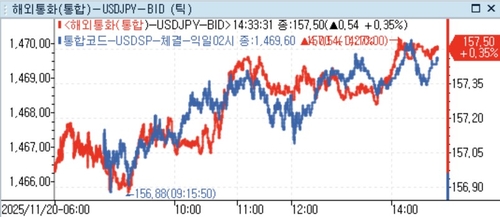

As of 14:25 KST on the 20th, the dollar-won rate was trading at 1,468.90 won, up 3.30 won from the previous session in the Seoul foreign exchange market.

During the afternoon session, the rate climbed as high as 1,470.10 won.

This marks the first time in four trading days since the 14th that the dollar-won has traded above the 1,470 level.

On the 14th, South Korea’s foreign exchange authorities issued verbal intervention comments aimed at stabilizing the exchange rate, prompting heightened vigilance over potential intervention in the dollar-won market.

Since then, the dollar-won rate has posted gains for four consecutive sessions.

The intraday high at the 1,470 level was largely driven by continued weakness in the yen, as well as demand for foreign exchange settlements by importers and dividend payments to foreign shareholders by Samsung Electronics Co., South Korea’s largest company by market value, which provided support for the lower end of the range.

The dollar-yen rate rose to as high as 157.54 yen, despite verbal intervention by Japanese authorities.

Japan’s foreign exchange authorities stated they are closely monitoring the dollar-won rate, citing speculative moves in the market.

Minoru Kihara, Japan’s Chief Cabinet Secretary, said at a regular press briefing, “There have been unilateral and rapid movements,” adding, “We are concerned.”

He further noted, “As the yen weakens against the dollar, authorities will closely monitor the market.”

He emphasized, “It is important for exchange rates to move stably and reflect fundamentals. The government is closely monitoring excessive volatility and disorderly movements in the market, including speculative trends.”

After the dollar-won breached the 1,470 level, the pace of gains slowed as market participants became wary of possible intervention by authorities and as exporters’ dollar-selling (so-called ‘nego’ supply) was anticipated.

Meanwhile, South Korea’s benchmark KOSPI index rose by 2.55%.

Foreign investors were net buyers of 496.2 billion won ($370 million) worth of stocks on the Korea Exchange.

syjung@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.