(Seoul=Yonhap Infomax) Min Jae Lee – The dollar-yen exchange rate climbed to its highest level in nearly 10 months in Tokyo trading, extending gains despite verbal intervention from Japanese authorities.

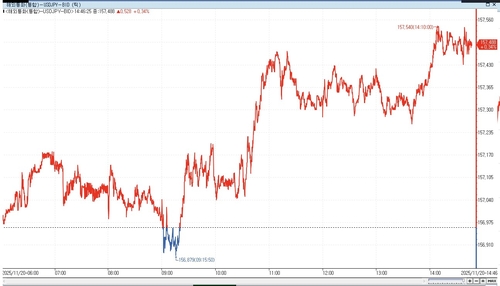

According to Yonhap Infomax (screen number 6411), as of 14:46 local time, the dollar-yen was trading at 157.488 yen, up 0.34% from the previous session.

The pair had been range-bound through mid-morning, but after 11:00 AM, the dollar strengthened further, reaching as high as 157.469 yen—a level not seen since January, marking a 10-month high.

The move followed a retreat in expectations for direct intervention by Japanese authorities, with the yen extending its overnight losses from New York trading.

At a three-way meeting held the previous day between Bank of Japan (BOJ) Governor Kazuo Ueda, Finance Minister Satsuki Katayama, and Economic Revitalization Minister Minoru Kiuchi, no specific discussions on the exchange rate reportedly took place.

Additionally, growing market consensus that the US Federal Reserve will hold off on rate cuts until December provided further support for the dollar.

The US Bureau of Labor Statistics (BLS) canceled the release of its October employment report, while the minutes from the October Federal Open Market Committee (FOMC) meeting were interpreted as hawkish, increasing the likelihood that the Fed will keep rates unchanged next month.

Comments from Japanese officials failed to alter the direction of the exchange rate.

Chief Cabinet Secretary Minoru Kihara said at a regular morning press briefing that he was "concerned about the recent one-sided and rapid movements in the exchange rate." He added that authorities are "closely monitoring excessive volatility or disorderly moves," but the market did not interpret these remarks as a stronger warning against yen weakness, limiting their impact on the currency.

Junko Koeda, Policy Board Member at the Bank of Japan, stated at a financial and economic meeting in Niigata Prefecture that "normalizing interest rates to restore real rates to a balanced state is necessary to avoid unintended distortions in the future."

An FX manager at a Japanese bank commented that Koeda's remarks did not signal heightened concern over the recent yen depreciation or accelerating inflation, and thus did not provide support for the yen.

After these comments, the dollar-yen rate appeared to face some resistance but resumed its upward momentum in afternoon trading.

Meanwhile, the dollar index, which measures the greenback against six major currencies, was up 0.09% at 100.276.

The euro-yen rate hit a fresh all-time high of 181.45 yen at one point, while the euro-dollar rate slipped 0.09% to 1.15150 dollars.

mjlee@yna.co.kr

(End)

Exchange Rate Data Table

| Date | Exchange Rate (USD/JPY) |

|---|---|

| 2025-11-20 | 157.4880 |

| 2025-01-XX | 157.4690 |

Trend Analysis

The dollar-yen exchange rate has reached its highest level since January, reflecting persistent yen weakness amid expectations of prolonged US monetary tightening and limited intervention by Japanese authorities. The dollar index also edged higher, while the euro-yen hit a record high, underscoring broad-based yen depreciation.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.