(Seoul=Yonhap Infomax) Yoon Woo Shin — The dollar-won exchange rate climbed on continued yen weakness and a strengthening US dollar.

Despite Nvidia Corp.'s stronger-than-expected earnings boosting South Korea's benchmark KOSPI index and prompting foreign investors to return as net buyers, the dollar-won rate continued its upward trajectory.

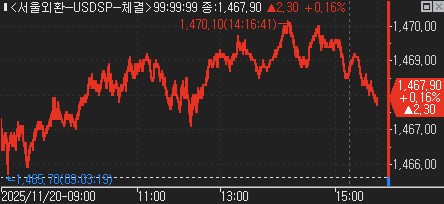

At 15:30 KST on the 20th, the dollar-won closed regular trading at 1,467.90 won, up 2.30 won from the previous session in the Seoul foreign exchange market.

The pair opened at 1,467.40 won, up 1.80 won, and steadily extended gains throughout the session.

During intraday trading, the rate briefly surpassed the 1,470-won level, reaching as high as 1,470.10 won, before paring gains into the close.

Persistent yen depreciation and a robust dollar trend continued to push the dollar-won higher.

Amid expectations for fiscal expansion and ongoing monetary easing in Japan, the yen continued to weaken overnight, with the dollar-yen rate surpassing 157 yen and approaching 158 yen during Asian trading.

Japan's Chief Cabinet Secretary Minoru Kihara expressed concern over recent "one-sided and rapid" moves in the foreign exchange market, hinting at verbal intervention, but the dollar-yen uptrend remained intact.

The US dollar also maintained its upward momentum. The dollar index climbed above 100 in the previous session and continued to rise.

This reflects diminished expectations that the US Federal Reserve (Fed) will cut its benchmark rate in December.

Additionally, Samsung Electronics Co., South Korea's largest company by market value, paid out more than $900 million in dividends to foreign investors the previous day, further supporting upward pressure on the dollar-won rate.

Conversely, the KOSPI's rebound—buoyed by Nvidia's strong results—and foreign stock buying exerted downward pressure on the dollar-won.

The KOSPI reclaimed the 4,000-point level, closing at 4,004.85, up 1.92%. Foreign investors were net buyers of over 640 billion won ($480 million) in the main board, marking a return to net buying after three sessions.

Authorities' vigilance as the dollar-won approached 1,470 and the potential for exporter dollar sales also capped the upside.

Later tonight, the delayed release of the US September employment report and speeches by senior Fed officials—including Governor Lisa Cook, Cleveland Fed President Beth Hammack, and Chicago Fed President Austan Goolsbee—are scheduled.

In currency futures, foreign investors were net buyers of roughly 13,000 dollar contracts.

The People's Bank of China set the yuan weaker, with the dollar-yuan reference rate at 7.0905, up 0.0033 yuan (0.05%) from the previous session.

Outlook for Next Trading Day

FX dealers remain cautious about the upside but still see room for further gains.

“The 1,470-won level is acting as a ceiling, but settlement demand is outpacing exporter dollar sales,” said a bank dealer. “Even exporters seem to be targeting levels above 1,470.”

He added, “With the US jobs data delayed, this trend is likely to persist for now. While it’s difficult to take aggressive long positions, the market bias remains upward.”

Another dealer noted, “Recently, we’ve seen steady intraday gains, a pullback before the close, and then renewed strength after regular trading. Just as the euro-won rate has been rising, the dollar-won could continue to climb.”

However, he cautioned, “If the National Pension Service begins FX hedging, sustained selling could drive the rate down significantly.”

Intraday Trends

The dollar-won opened at 1,467.40, up 1.80 won, tracking gains in the New York non-deliverable forward (NDF) market.

Intraday, the high was 1,470.10 won and the low was 1,465.70 won, for a trading range of 4.40 won.

The market average rate (MAR) is set to be announced at 1,468.40 won.

Spot FX turnover, combining Seoul Money Brokerage Services and Korea Money Brokerage Corp., totaled $8.121 billion.

The KOSPI closed at 4,004.85, up 1.92%, while the KOSDAQ rose 2.37% to 891.94.

Foreign investors were net buyers of 641.2 billion won ($480 million) in the main board and 182 billion won ($136 million) in the KOSDAQ.

Near the Seoul FX market close, the dollar-yen stood at 157.551, and the yen-won cross rate was 931.70 won per 100 yen.

The euro-dollar rate was 1.15220, and the dollar index was 100.237.

The offshore dollar-yuan (CNH) rate was 7.1170.

The direct yuan-won rate closed at 206.25 won per yuan, with an intraday low of 206.04 and high of 206.47. Combined turnover at Korea Money Brokerage Corp. and Seoul Money Brokerage Services was 15.968 billion yuan.

*

ywshin@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction, redistribution, or AI training/use prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.