(Seoul=Yonhap Infomax) Sung Jin Kim = The US Treasury's auction of 10-year Treasury Inflation-Protected Securities (TIPS) on the 20th (local time) saw weaker-than-expected demand, resulting in a yield that exceeded market forecasts.

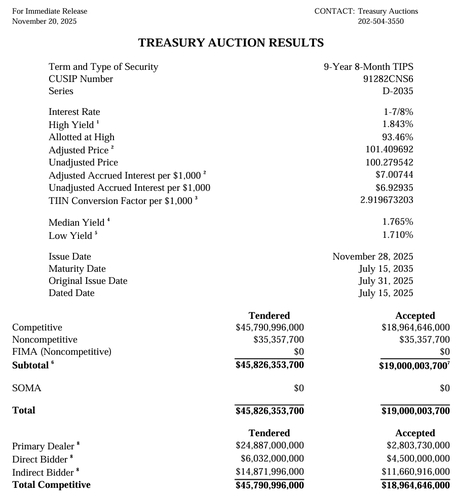

According to the US Treasury, the $19 billion auction of 10-year TIPS was awarded at a yield of 1.843%. This is up 10.9 basis points from the previous auction in September, which saw a yield of 1.734%.

The bid-to-cover ratio reached 2.41, higher than the previous auction's 2.20 and above the average of 2.32 over the last three auctions.

The awarded yield was about 1.9 basis points above the when-issued trading yield, indicating a significantly higher yield than market expectations.

Indirect bidders, which reflect overseas investor demand, accounted for 61.5% of the auction, up 5.4 percentage points from the previous auction. Direct bidders took 23.7%, down 2.4 percentage points. The share absorbed by primary dealers, who take up unsold amounts, fell by 3.0 percentage points to 14.8%.

sjkim@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.