(Seoul=Yonhap Infomax) Ha Rin Song – Hyundai Motor Co. has dispelled concerns over negative growth following its third-quarter earnings announcement this year, prompting analysts to now consider the stock a buy.

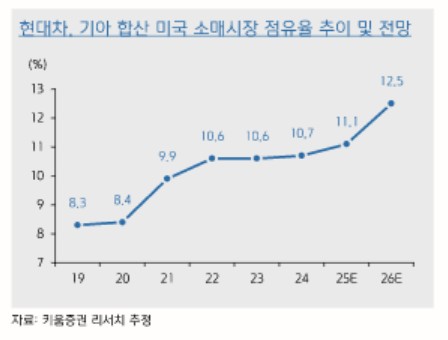

Shin Yoon-chul, analyst at Kiwoom Securities, upgraded his investment rating on Hyundai Motor from 'Outperform' to 'Buy' on the 21st, newly designating it as a top pick.

The target price was also raised further to 340,000 won ($255) from 310,000 won at the end of last month, which itself was an increase from the previous 200,000 won range.

Shin noted that, following the third-quarter results, consensus forecasts for Hyundai Motor's 2025 operating profit growth shifted from -3.9% to +4.9%, while net profit growth expectations turned from -2.3% to +4.5%.

Key drivers for next year's earnings improvement include increased sales of new hybrid electric vehicles (HEVs), expanded high-margin deliveries to India, and the confirmation of a 15% tariff rate on certain items.

"With concerns over three consecutive years of negative growth now resolved, the foundation for a recovery in investor sentiment has been established," Shin said. "Previous worries about a reduction in shareholder returns due to potential net profit contraction next year are also expected to dissipate."

Shin expects Hyundai Motor to replicate the stock rally seen in the first half of 2019.

"The two-year streak of operating profit declines from 2016 to 2018, following the THAAD deployment, was driven by external factors such as diplomatic and trade issues, as well as large-scale quality costs," Shin explained. "This is similar to the two-year operating profit contraction expected from 2023 to 2025. In 2019, when there was no labor strike, Hyundai Motor returned to earnings growth and significantly outperformed the index through the first half."

hrsong@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.