(Seoul=Yonhap Infomax) Kyu Sun Lee – As the correction in U.S. technology stocks continues, South Korean retail investors—often referred to as "Seohak Ants" for their overseas trading activity—are aggressively buying up small- and mid-cap growth stocks that have seen steep declines. Despite heightened market volatility, these investors are viewing the downturn as a buying opportunity and are deploying significant capital.

Brokerages Advise Caution Amid Fundamental Reassessment

Market analysts caution that the recent sell-off may reflect a recalibration of expectations regarding company fundamentals, and recommend a prudent investment approach.

Persistent Buying Despite Price Drops—IonQ Ranks Third in Net Purchases

According to data from the Korea Securities Depository's SEIBro portal, net buying by domestic investors over the past month (October 21–November 19) has been concentrated in stocks with the sharpest declines.

Notably, IonQ Inc., a U.S.-listed quantum computing company, has attracted strong buying interest. IonQ shares have fallen approximately 41.6% from a peak of $82 on October 13 to around $47 as of the latest session.

Nevertheless, South Korean investors have net purchased $660 million (about 1 trillion won) of IonQ shares during this period, making it the third most bought stock after Nvidia Corp. ($820 million) and Meta Platforms Inc. ($690 million).

Interest in highly volatile stocks remains robust. Beyond Meat Inc., a plant-based meat producer whose shares have dropped below $1 due to poor earnings, ranked 12th in net purchases at $170 million.

Additionally, leveraged ETFs tracking the performance of small modular reactor (SMR) and quantum computing indices—amplifying gains and losses by two times—have seen net inflows of $300 million following recent corrections.

Lessons from 2021—Stocks with Strong Earnings Visibility Favored

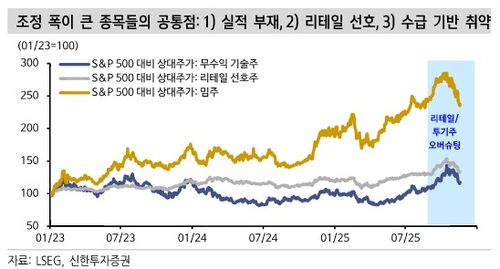

Brokerages are taking a cautious stance on this retail buying strategy. Hanbi Oh, a researcher at Shinhan Investment Corp., noted in a recent report that the most heavily sold-off stocks share three traits: 1) lack of clear earnings, 2) high retail investor preference, and 3) relatively weak demand fundamentals.

"These stocks are valued more on expectations than on actual earnings, so if hopes for rate cuts fade or market sentiment deteriorates, volatility could increase," Oh explained.

Oh compared the current situation to the correction in February 2021, when retail investors also bought loss-making growth stocks amid rate hike fears. However, subsequent performance diverged: major Nasdaq stocks with solid earnings rebounded quickly, while some theme stocks with weak fundamentals took much longer to recover.

Analysts also suggest that a sustained rally in theme stocks may require patience. Historically, such rallies tend to occur in the latter stages of a cycle, after large-cap leaders have risen for an extended period. Applying this to the current market, a full-fledged theme stock rally may not materialize until late 2026.

"A short-term rebound in oversold stocks is possible, but a sustained uptrend may be delayed," Oh advised. "Investors should rebalance portfolios toward high-quality stocks with strong earnings visibility."

*

kslee2@yna.co.kr

(End)

Copyright (c) Yonhap Infomax. All rights reserved. Unauthorized reproduction, redistribution, or use for AI training is strictly prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.