(Seoul=Yonhap Infomax) Sung Jin Kim—Korea Treasury Bond (KTB) futures advanced in overnight trading as expectations for a US Federal Reserve rate cut resurfaced.

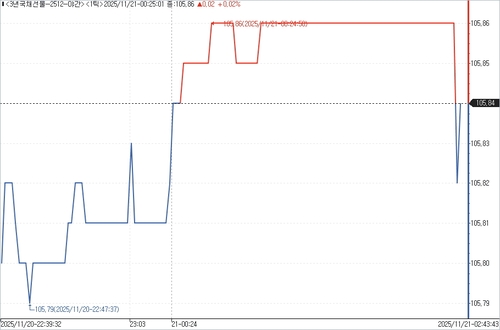

According to the Seoul bond market on the 21st, the 3-year KTB futures closed at 105.84 in overnight trading, up 7 ticks from the previous day’s regular session close. Foreign investors were net buyers of 40 contracts, while individuals were net sellers of 40 contracts.

The 10-year KTB futures ended 22 ticks higher at 114.00. Foreign investors net bought 20 contracts, while both financial investment institutions and individuals each net sold 10 contracts.

Trading volume for the 3-year contract increased to 402 contracts from 326 in the previous session. The 10-year contract volume declined to 61 from 429.

As of 06:53 KST, US Treasury yields were trending lower. The 10-year US Treasury yield fell 5.40 basis points from the previous New York close, while the 30-year yield dropped 3.60 basis points. The 2-year yield declined by 5.90 basis points.

Market sentiment for a Fed rate cut next month was revived after US unemployment in September rose to its highest level in nearly four years. Despite strong earnings from Nvidia, the New York stock market reversed lower during the session, further supporting rate cut expectations and contributing to the bullish tone.

According to the US Department of Labor, nonfarm payrolls increased by 119,000 in September, more than double the market consensus of 50,000. However, figures for the previous two months were revised down by 33,000. The August figure was revised from a 22,000 increase to a 4,000 decrease, marking a directional shift.

The unemployment rate for the same month rose 0.1 percentage point to 4.4%, the highest since October 2021 (4.5%). Analysts had expected the rate to remain at 4.3%.

sjkim@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.