(Sejong=Yonhap Infomax) Jun Hyung Park = The South Korean government is now expected to face an inevitable revenue shortfall of 3.7 trillion won ($2.8 billion) this year, after the planned sale of NXC Corp. shares—submitted in lieu of inheritance tax by the family of the late Nexon founder Kim Jung-ju—has effectively stalled.

There are growing concerns that the 3.7 trillion won valuation of these in-kind tax payment shares, which has been criticized as inflated, has ultimately increased uncertainty in the government’s revenue projections.

According to the National Assembly and the Ministry of Economy and Finance on the 21st, the budget for the “sale of in-kind tax payment shares” was put on hold during the budget subcommittee review, due to disagreements over the inclusion of NXC shares as revenue.

The ministry had estimated that 3.7 trillion won ($2.8 billion) from the sale of NXC shares would be booked as revenue this year, but it has become clear that these funds will not be realized within the year.

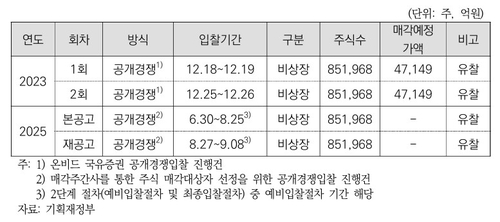

In 2023, the family of founder Kim Jung-ju submitted 851,969 shares (30.64%) of NXC Corp.—the holding company of Nexon Co., a major South Korean game developer—in lieu of inheritance tax.

The government valued the stake at a total of 4.7 trillion won ($3.6 billion), allocating 3.7 trillion won ($2.8 billion) to the 2025 budget and the remaining 1 trillion won ($760 million) to the 2026 budget.

The 4.7 trillion won valuation reflects a 20% premium under the “largest shareholder premium” rule applied in South Korea.

However, there are very few potential buyers willing to pay the 4.7 trillion won ($3.6 billion) price tag, especially as NXC is an unlisted company with limited liquidity.

Moreover, the founding family retains about 70% of NXC shares, meaning that even a full acquisition of the remaining 30% would not confer management control.

As a result, the government has failed to find a buyer despite three public sale attempts between December 2023 and September this year.

The delay in the sale has directly translated into uncertainty in revenue projections.

The 3.7 trillion won ($2.8 billion) in non-tax revenue included in this year’s budget will now be recorded as a deficit, and the outlook for next year remains uncertain.

The National Assembly Budget Office stated, “The combination of the inflated valuation and low sale probability of these shares is increasing uncertainty on the revenue side. If the sale does not proceed as planned, the government may have to issue government bonds or make unavoidable spending adjustments, which could undermine overall fiscal soundness.”

While the government has repeatedly expressed its intention to expedite the sale of the NXC shares, the process is currently on hold following President Lee Jae-myung’s directive to suspend government asset sales.

An official from the Ministry of Economy and Finance said, “There are conflicting opinions on whether to include 3.7 trillion won or maintain 1 trillion won in next year’s budget, so the review has been postponed. No concrete decision has been made yet.”

However, some argue there is no need to rush the sale of the NXC stake.

According to the office of Cha Kyu-geun, a lawmaker from the Korea Innovation Party, the ministry has received a total of 12.78 billion won ($9.7 million) in dividends from NXC.

Rep. Cha said, “Although the NXC shares are unlisted in-kind tax payment shares, they continue to generate dividend income. The government should take sufficient time to sell at an appropriate price rather than rushing.”

The recent surge in the corporate value of Nexon Co., NXC’s main subsidiary, also supports the argument for patience. Nexon, listed on the Tokyo Stock Exchange, has seen its share price hit a record high of 3,746 yen following the success of new games such as “Mabinogi Mobile” and “Arc Raiders.” Its market capitalization is now approaching 30 trillion won ($22.8 billion).

jhpark6@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.