(Seoul=Yonhap Infomax) Hye Rim Pi – With the National Assembly passing a bill easing requirements for local government bond issuance, South Korea’s municipalities are expected to ramp up bond sales to cover fiscal shortfalls, raising questions over whether this could become a hidden supply risk for the domestic bond market.

Currently, local government bonds account for a relatively small share of the overall bond market, and most analysts believe the additional supply will not overwhelm market absorption capacity.

However, some caution that if market conditions deteriorate—such as a weakening in investor sentiment—there could be pressure from demand dispersion and widening credit spreads.

The anticipated increase in local government bond issuance is also drawing attention to the funding trends of local urban development corporations, which have served as alternative funding channels for municipalities.

Local Governments Step Up Bond Issuance Plans

According to investment banking industry sources on the 21st, the Seoul Metropolitan Government issued 240 billion won ($178 million) in local government bonds the previous day.

The bonds have a 15-year maturity, with a spread 30 basis points above the yield on government bonds of the same tenor.

The auction held the day before the issuance attracted orders totaling 390 billion won ($289 million).

Other major cities, including Daejeon and Busan, are also preparing to issue local government bonds.

Historically, local government bonds have been a niche segment in the Seoul bond market due to their limited issuance volume.

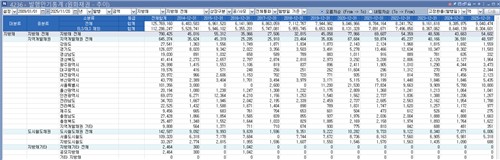

According to Yonhap Infomax’s “Issuance Maturity Statistics” (screen number 4236), total local government bond issuance last year stood at 4.3663 trillion won ($3.24 billion).

Given that annual corporate bond issuance exceeds 90 trillion won ($66.8 billion), the local government bond market remains relatively small.

The recent legislative amendment, which relaxes the requirements for local government bond issuance, is shifting sentiment among municipalities.

Under the revised law, local governments can now issue bonds to cover “unforeseen urgent fiscal needs,” expanding beyond the previously limited purposes such as public asset formation, disaster prevention and recovery, and grant shortfall compensation.

This change could see some municipalities tapping the bond market to fund public welfare initiatives, such as consumer coupon programs.

Declining tax revenues are also prompting local governments to seek more bond financing.

For example, Daegu Metropolitan City included local government bond issuance in its 2026 budget plan, marking its first such issuance in four years, with a planned volume of 200 billion won ($148 million).

Despite the expected increase in issuance, market concerns remain muted for now.

“Local government bonds are still small compared to the overall credit market, so the market should be able to absorb the supply,” said a bond market participant.

A bond dealer at a securities firm added, “Issuance has been so limited that the market hasn’t really felt the impact, so there’s little concern about increased supply at this stage.”

Market Conditions and Timing of Issuance Are Key

The situation could change if market conditions become volatile.

If local government bond issuance continues amid weak investor sentiment, it could lead to wider spreads.

Given that local government bonds are considered quasi-sovereign, any spread widening could have a significant impact on the broader credit market.

“Local government bonds are not highly liquid, so if issuance increases during periods of heightened credit risk, it could burden the market,” said another bond market participant. “Issuance timing will be crucial, especially if market conditions worsen.”

Supply dispersion is another factor that could weigh on the market.

At times, demand for local government bonds has overlapped with that for corporate bonds, affecting auction outcomes.

For instance, when municipalities and public enterprises held bond auctions for similar maturities on the same day, demand for corporate bonds weakened.

In response, public enterprises had to raise issuance spreads or adjust issuance volumes by maturity.

Moreover, local government bond issuance has already accelerated this year.

With the legal amendment in place, municipalities are likely to further step up bond financing.

From January through the previous month, local government bond issuance totaled 4.8942 trillion won ($3.63 billion), up 56.5% from 3.1257 trillion won ($2.32 billion) in the same period last year.

With the latest issuance, total local government bond funding this year has already surpassed 5.4 trillion won ($4.01 billion).

Over the past decade, annual local government bond issuance exceeded 5 trillion won ($3.71 billion) only between 2020 and 2022.

The expected increase in local government bond issuance is also drawing attention to the bond issuance trends of urban development corporations.

As municipalities have increasingly relied on these corporations for project funding, their bond issuance has also grown.

“Local governments have traditionally raised funds through urban development corporations,” said Kim Sang-man, Senior Research Fellow at Hana Securities. “If both local government and urban development corporation bond issuance rise, it will be important to assess the impact on the corporate bond market.”

phl@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.