(Seoul=Yonhap Infomax) Min Jae Lee – On November 21, Japan’s Nikkei 225 index tumbled more than 2% in early trading, weighed down by a sharp correction on Wall Street overnight.

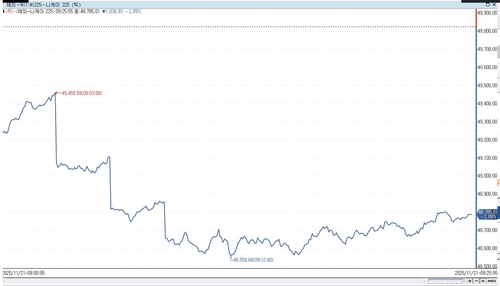

As of 09:28 local time, the Nikkei 225 was down 1,079.57 points, or 2.17%, at 48,744.37. The broader TOPIX index slipped 17.03 points, or 0.52%, to 3,282.54.

The Nikkei opened 1.15% lower and at one point extended losses to 2.54% in early trade.

The sell-off followed a broad retreat in US equities, where all three major indices closed lower. The tech-heavy Nasdaq led declines, dropping 2.15% amid renewed concerns over a potential artificial intelligence (AI) bubble and warnings from senior Federal Reserve officials about the risk of a sharp correction in financial assets. This triggered a wave of selling in technology shares.

Japanese semiconductor-related stocks also came under pressure, mirroring the tech sell-off in the US. Analysts noted that the Nikkei’s sharp rally of over 2% the previous day, fueled by strong earnings from Nvidia, contributed to today’s reversal.

Japan’s trade balance for October, released before the market opened, showed a deficit of 231.7 billion yen (approximately $1.57 billion), narrower than the market consensus of a 280 billion yen shortfall, according to the Ministry of Finance.

Meanwhile, the dollar-yen exchange rate was trading at 157.513 yen, down 0.04% from the previous session. The yen briefly strengthened following verbal intervention by Japanese authorities in the foreign exchange market, but soon returned to previous levels.

mjlee@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.