(Seoul=Yonhap Infomax) Seon Mi Jeong – The dollar-won exchange rate climbed above the 1,470-won mark on Thursday, tracking heightened risk aversion after a sharp decline in U.S. tech stocks and a steep drop in South Korea's benchmark KOSPI index.

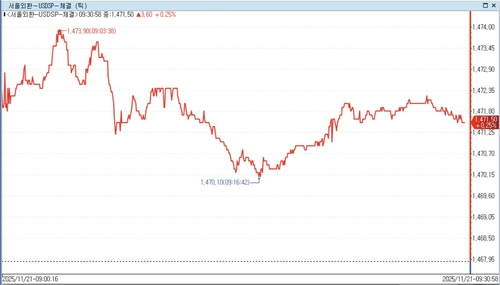

As of 09:30 KST on the 21st, the dollar-won rate was trading at 1,471.60 won, up 3.70 won from the previous session. The pair opened at 1,472.40 won, a rise of 4.50 won from the prior close.

Despite Nvidia Corp. posting record earnings, the tech-heavy Nasdaq Composite Index fell more than 2% overnight, triggering a correction in technology shares. This led to a bearish start for the domestic market, with the KOSPI tumbling over 3% in early trading and foreign investors net selling more than 800 billion won ($610 million) in local equities.

The U.S. dollar remained firm, with the dollar index holding above the 100 level, supported by robust September nonfarm payrolls data. However, the U.S. unemployment rate rose to 4.4%, the highest since October 2021 (4.5%), prompting a slight uptick in market expectations for a December rate cut to around 40%.

Persistent yen weakness has prompted repeated verbal interventions from Japanese authorities. Japanese Finance Minister Satsuki Katayama recently noted that the exchange rate has been moving in a one-sided and rapid manner. The dollar-yen pair edged down to around 157.4 yen, while the dollar index traded in the mid-100.1 range.

“With the KOSPI sharply lower, the exchange rate is also trending higher,” said a foreign exchange dealer at a local bank. “There is some caution about intervention around the 1,475-won level, which has slightly reduced the volume of settlement-related dollar selling.”

He added, “Nevertheless, the strong dollar trend continues, and with the perception that the September U.S. jobs report is backward-looking, uncertainty is rising, prompting a flight to safe-haven assets. There is a possibility the rate could reach 1,477 won during Asian trading hours.”

At the same time, the dollar-yen rate was quoted at 157.491 yen, down 0.082 yen from the New York close, while the euro-dollar rate was at 1.15304, up 0.00045. The yen-won cross rate stood at 934.36 won per 100 yen, and the yuan-won rate was at 206.73 won. The KOSPI was down 3.38%, with foreign investors net selling approximately 956.7 billion won ($730 million). Offshore dollar-yuan (CNH) was at 7.1165 yuan.

smjeong@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.