(Seoul=Yonhap Infomax) Yo Been Noh – South Korea's benchmark KOSPI index extended losses on Thursday morning, pressured by renewed concerns over an artificial intelligence (AI) bubble and a sharp rise in the won-dollar exchange rate, prompting foreign investors to offload nearly 2 trillion won ($1.5 billion) in local equities.

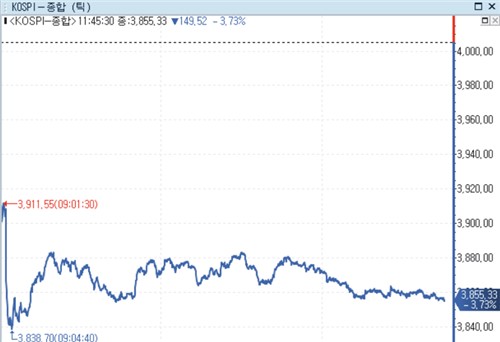

As of 11:44 a.m. KST on the 21st, the KOSPI had tumbled 3.70% to 3,856.63, deepening its decline after opening 2.40% lower at 3,908.70. Despite robust earnings from Nvidia Corp., persistent doubts over AI profitability weighed on investor sentiment, mirroring the overnight sell-off in U.S. tech stocks.

Major South Korean semiconductor stocks, including Samsung Electronics Co., the nation's largest company by market capitalization, and SK hynix Inc., faced heavy selling. SK hynix plunged as much as 9.98% intraday, while Samsung Electronics dropped 5.86%, dragging the broader index below the 3,900 mark to an intraday low of 3,838.70.

Foreign investors led the sell-off, expanding their net sales to nearly 2 trillion won ($1.5 billion) after the market opened. In contrast, retail investors purchased about 1.7 trillion won ($1.3 billion), and institutional investors bought approximately 220 billion won ($165 million).

The combination of broad-based skepticism over AI and the continued rise in the exchange rate fueled the foreign exodus. The won-dollar rate climbed for a fifth consecutive session, reaching a high of 1,473.90 won per dollar, up 6 won from the previous day, as risk-off sentiment intensified.

ybnoh@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.