(Seoul=Yonhap Infomax) Min Jae Lee – Michael Burry, the famed Wall Street investor portrayed in the film "The Big Short," has once again delivered a scathing critique of Nvidia Corp. and related artificial intelligence (AI) companies.

Burry questioned the lifespan of Nvidia’s chips, the circular trading practices within the AI sector, and the real impact of share buybacks.

According to Business Insider (BI) on the 21st, Burry unleashed a series of pointed criticisms on his X (formerly Twitter) account immediately following Nvidia’s earnings release.

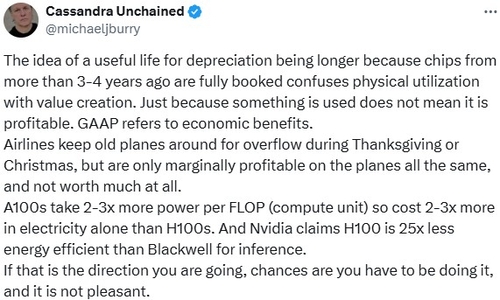

In his first post, Burry highlighted concerns that major AI firms are inflating their earnings by extending the depreciation period of computing equipment. He argued that the continued use of older Nvidia chips by customers does not, from an accounting perspective, justify a longer useful life.

“Companies are confusing physical usage with value creation,” Burry wrote. “Just because something is being used doesn’t mean it’s profitable.”

He drew a parallel to airlines that retain aging aircraft to boost capacity during peak seasons, noting, “They generate only marginal profits and have little intrinsic value.”

In subsequent posts, Burry pointed to the complex web of multi-billion-dollar circular transactions—so-called “give-and-take deals”—among Nvidia, OpenAI, Microsoft, Oracle, and others. He asserted, “True end demand is absurdly low,” and claimed that “almost every customer is being financially supported by the supplier (Nvidia).”

In his final post, Burry alleged that Nvidia has repurchased nearly $113 billion worth of its own shares since early 2018, yet the number of shares outstanding has actually increased by 47 million. He attributed this to stock-based compensation for employees, estimating that “shareholder returns have been cut by 50%.”

mjlee@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.