(Seoul=Yonhap Infomax) Ji Yeon Kim – The dollar-won exchange rate continued to test the upper range in the mid-1,470s on Thursday, driven by heightened risk aversion and sustained foreign equity outflows.

As of 11:16 AM KST on the 21st, the dollar-won was trading at 1,473.40, up 5.50 won from the previous session. The pair opened at 1,472.40, a 4.50-won increase from the prior close, after breaching the 1,470 level in overnight trading amid a sharp selloff on Wall Street fueled by concerns over an AI-driven bubble.

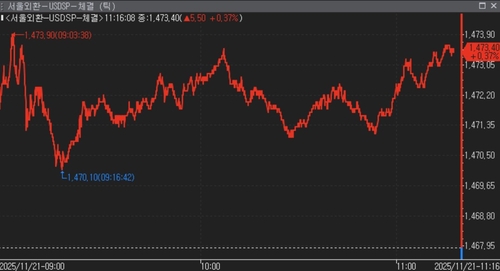

Early in the session, the dollar-won touched an intraday high of 1,473.90. Exporters’ dollar-selling at the upper end briefly pared gains, sending the rate down to 1,470.10, but the downside was supported as South Korea’s benchmark KOSPI index slumped more than 3%.

During the session, foreign investors net sold over 1.8 trillion won ($1.4 billion) in KOSPI-listed stocks, prompting large-scale custodial dollar buying and adding persistent upward pressure on the exchange rate.

Japan’s Finance Minister, Satsuki Katayama, said at a press conference that “foreign exchange intervention remains an option to address excessive volatility and speculative moves,” signaling a potential for action. Bank of Japan Governor Kazuo Ueda told parliament that “yen weakness could impact inflation,” but his comments had limited effect on the dollar-yen rate, which held in the 157 range amid caution over the government’s large-scale stimulus plans.

Meanwhile, Japan’s Ministry of Internal Affairs and Communications reported that the October core consumer price index (excluding fresh food) rose 3.0% year-on-year. Major Japanese media noted that “persistent inflation is squeezing households,” and while the government is pursuing anti-inflation measures, the ongoing yen depreciation clouds the outlook for price stabilization.

Later tonight, speeches are scheduled from John Williams, President of the Federal Reserve Bank of New York; Michael Barr, Federal Reserve Board Governor; Philip Jefferson, Vice Chair of the Federal Reserve; and Lorie Logan, President of the Dallas Fed. Key U.S. data releases include the November S&P Global Manufacturing and Services PMIs, the University of Michigan’s November consumer sentiment index, and inflation expectations.

The People’s Bank of China set the dollar-yuan central parity rate at 7.0875, a 0.04% appreciation from the previous session. The dollar index slipped to 100.14.

In currency futures, foreign investors net sold over 8,000 contracts of dollar futures.

Afternoon Outlook

FX dealers expect the dollar-won to search for direction in the low-to-mid 1,470s in the afternoon session. “There appears to be some dollar selling pressure above 1,470, but the overall level remains elevated,” said a dealer at a securities firm. “With the yen approaching 160, the market still favors dollar buying.”

A bank FX dealer added, “The intraday trend is unclear amid range-bound trading. The NDF (non-deliverable forward) market moved above 1,470 after last night’s U.S. nonfarm payrolls data, which seems to have influenced the spot rate.” He noted, “When the rate rises, exporter dollar sales tend to cap gains, but foreign equity outflows are not having a major impact on the exchange rate.”

Intraday Trends

The dollar-won opened 4.50 won higher, tracking gains in the New York NDF one-month contract. The intraday high was 1,473.90, with a low of 1,470.10, marking a 3.80-won trading range.

According to Yonhap Infomax’s estimated trading volume (screen no. 2139), turnover stood at approximately $3.4 billion as of the reporting time.

At the same time, foreign investors net sold 1.8281 trillion won ($1.4 billion) in KOSPI stocks and 98.3 billion won ($75 million) in KOSDAQ shares.

The dollar-yen was quoted at 157.481, down 0.103 yen from the New York close, while the euro-dollar traded at 1.15320, up 0.00072. The yen-won cross rate was 934.47 per 100 yen, and the yuan-won rate was 206.83. The offshore dollar-yuan (CNH) rate fell to 7.1141.

*

jykim2@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction, redistribution, AI training, or use is prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.