(Seoul=Yonhap Infomax) Seon Mi Jeong—The dollar-won exchange rate surged to the mid-1,470s, marking its highest level in over seven months.

Heavy net selling by foreign investors in South Korea's main stock market, exceeding 2.8 trillion won ($2.1 billion), fueled strong custodial dollar demand and pushed the dollar-won rate higher.

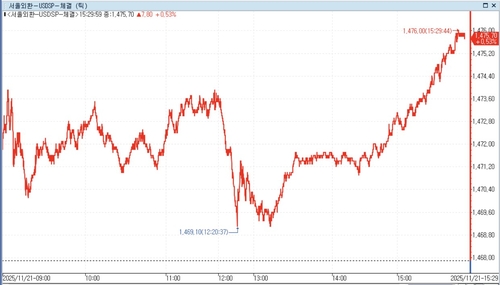

On November 21, the dollar-won closed regular trading at 1,475.60, up 7.70 won from the previous session, according to the Seoul foreign exchange market at 15:30 KST.

This marks the highest closing level since April 9, when the rate ended at 1,484.10.

The session opened at 1,472.40, reflecting gains in the offshore non-deliverable forward (NDF) market. The rate hovered near 1,473 through midday, with upside capped as authorities had previously defended the 1,475 level through verbal intervention and fine-tuning measures.

Despite some exporter dollar selling that briefly pushed the rate down to 1,469.10, the dollar-won rebounded to around 1,471 and traded sideways before climbing further after 14:00 KST. Late-session buying emerged, with some market participants noting that the dollar-Taiwan dollar also began to rise, influencing the move.

Overnight, the New York stock market saw sharp declines led by tech shares. In response, South Korea's benchmark KOSPI index fell 3.79% to 3,853.26, and the KOSDAQ dropped 3.14% to 863.95. Foreign investors net sold more than 2.8 trillion won ($2.1 billion) in KOSPI shares.

The US dollar index edged up in New York but weakened in Asia as the yen strengthened. Ahead of the open, Japanese Finance Minister Shunichi Katayama highlighted recent one-sided and rapid moves in the FX market. Bank of Japan Governor Kazuo Ueda told parliament that yen weakness could impact inflation, but his comments had limited effect on the dollar-yen rate.

In the afternoon, Japan announced a stimulus package totaling 21.3 trillion yen ($141 billion), the largest since the COVID-19 pandemic. The dollar-yen, which had risen on expectations of a package above 20 trillion yen, retreated to 157.2 as some short yen positions were unwound.

The dollar index fell below 100.2, with the dollar-yen trading around 157.14. The People's Bank of China set the dollar-yuan reference rate at 7.0875, a 0.04% appreciation from the previous session.

Foreign investors were net sellers of 13,967 contracts in dollar futures on the currency futures market.

Later tonight, speeches are scheduled from John Williams, President of the Federal Reserve Bank of New York; Michael Barr, Federal Reserve Board Governor; Philip Jefferson, Vice Chair of the Federal Reserve; and Lorie Logan, President of the Dallas Fed. Key US data releases include November S&P Global Manufacturing and Services PMIs, as well as the University of Michigan's consumer sentiment and inflation expectations indices.

Outlook for Next Trading Day

FX dealers expect the dollar-won to remain biased to the upside, though further gains may be capped by potential intervention and hedging by the National Pension Service.

“The market was range-bound early on, but as participants waited and supply emerged with a time lag, the rate eventually moved higher,” said a dealer at a major bank. “With 1,480 seen as the upper bound, there is room for further gains, but immediate intervention or hedging by the National Pension Service seems unlikely.”

Another dealer noted, “Late-session custodial buying drove the rate higher, while exporter selling was only notable around midday.” He added, “While the bias is upward, caution over intervention means the upside is still somewhat limited.”

Intraday Market Trends

The dollar-won opened at 1,472.40, up 4.50 won from the previous session, reflecting gains in the New York NDF market. The intraday high was 1,476.00 and the low was 1,469.10, for a trading range of 6.90 won.

The market average rate (MAR) is expected to be set at 1,472.00. Combined spot FX trading volume at Seoul Money Brokerage Services and Korea Money Brokerage Corp. totaled $8.518 billion.

The KOSPI closed down 3.79% at 3,853.26, while the KOSDAQ fell 3.14% to 863.95. Foreign investors net sold 282.2 billion won ($211 million) in KOSPI shares and 127.1 billion won ($95 million) in KOSDAQ shares.

At the close of the Seoul FX market, the dollar-yen was at 157.11, and the yen-won cross rate was 939.37 per 100 yen. The euro-dollar traded at 1.15463, and the dollar index stood at 100.061. The offshore dollar-yuan (CNH) was at 7.1155, while the yuan-won direct rate closed at 207.3 per yuan, with a low of 206.53 and a high of 207.3. Combined trading volume at Korea Money Brokerage Corp. and Seoul Money Brokerage Services was 9.925 billion yuan.

smjeong@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.