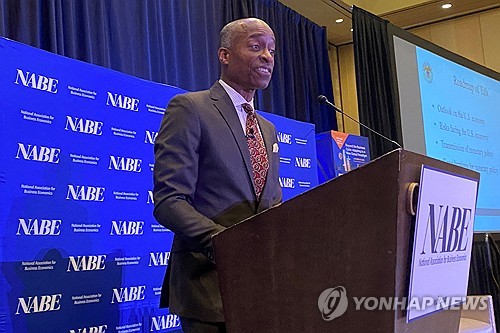

(Seoul=Yonhap Infomax) Jung Won Yoon – Philip Jefferson, Vice Chair of the US Federal Reserve (Fed), emphasized that the recent AI-driven stock market rally is fundamentally different from the dot-com bubble era.

On the 21st (local time), speaking at the Cleveland Federal Reserve Bank’s Financial Stability Conference, Jefferson said, “Differences between today’s market and the dot-com era have reduced the likelihood of a repeat of the late 1990s.”

He identified three main distinctions between the current AI boom and the dot-com bubble:

- During the dot-com bubble, most related companies had little to no profit potential or only speculative revenue forecasts. In contrast, today’s AI firms are generally well-established and show growing revenue streams.

- Based on these earnings, the price-to-earnings ratios (PER) of AI companies are lower than at the peak of the dot-com bubble.

- While there were around 1,000 listed dot-com companies at the time, only about 50 publicly traded firms are currently considered AI companies, suggesting investor enthusiasm is not as concentrated as before.

Jefferson noted, “Unlike the dot-com bubble, today’s AI-related stock market is more focused on companies generating real profits and is developing against the backdrop of a healthy and resilient financial system.”

He also stated that advances in AI could influence monetary policy decisions. “Productivity gains from AI may affect the relationship between employment and inflation, and thus could impact the implementation of monetary policy,” Jefferson said.

However, he cautioned that monetary policy should be based on a broad perspective of the overall economy, not determined by a single sector or technology.

“It is still too early to assess the impact of AI on monetary policy,” Jefferson added. “Policymakers need to distinguish whether changes in the economy are due to cyclical factors or structural shifts represented by AI.”

jwyoon2@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.