(New York=Yonhap Infomax) Jin Woo Choi—The US services sector showed stronger-than-expected growth in November, while manufacturing, though below forecasts, continued to expand and supported the broader economy.

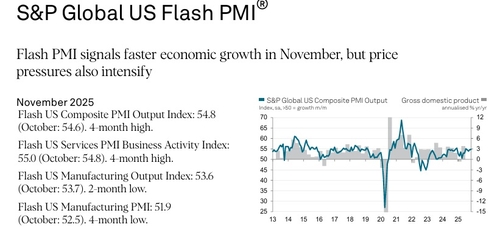

According to S&P Global on the 21st (local time), the preliminary US Services Purchasing Managers’ Index (PMI) for November rose to 55.0, up 0.2 points from October’s 54.8.

This figure exceeded market expectations of 54.5 and marked the highest level in four months.

A PMI reading above 50 indicates economic expansion, while below 50 signals contraction.

In contrast to the improvement in services, the preliminary Manufacturing PMI for November fell to 51.9, down 0.6 points from the previous month’s 52.5, and below the market consensus of 52.0.

The composite PMI, which combines manufacturing and services, climbed to 54.8 from 54.6, also reaching a four-month high.

Overall, the services sector is leading the economic recovery, with manufacturing still providing support, albeit less robustly than before.

However, finished goods inventories in manufacturing posted the largest increase in 18 and a half years since the survey began.

Supplier lead times have lengthened for three consecutive months due to tariffs.

Manufacturing employment grew at the fastest pace in three months, while hiring in services was more moderate and slower than in October.

Input cost inflation for both manufacturing and services accelerated sharply. Excluding the surge in May, this was the fastest pace in three years, according to S&P.

S&P explained, “Companies cited tariffs as the main driver of rising costs, with wage increases also reported.”

Service sector input costs rose at the fastest rate since January 2023.

Conversely, manufacturing input costs slowed to their lowest level since February, though still well above the three-year average.

Business outlook for the next year reached its highest level since January. Manufacturing optimism hit a five-month high, while services reached an 11-month peak.

Chris Williamson, Chief Business Economist at S&P Global, said, “The US economy is performing quite robustly in November, with Q4 growth tracking at an annualized pace of about 2.5% so far.”

He added, “It is encouraging to see a broad-based recovery, with output rising not only in manufacturing but across the vast services sector.”

Williamson also noted, “Business confidence for next year has clearly improved, supported by expectations of further rate cuts and the end of the federal government shutdown, while political concerns have generally eased, boosting economic sentiment.”

However, he cautioned, “There are areas of concern. Manufacturers reported a record build-up in finished goods inventories amid slowing new order growth. If these unsold inventories persist, factory output could see slower gains in the coming months, which may also constrain growth in several service industries.”

He further stated, “Employment continued to rise in November, but companies are moderating hiring due to rising costs, including those related to tariffs. Both input costs and selling prices accelerated in November, which could be a concern for inflation hawks.”

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.