(Seoul=Yonhap Infomax) Sung Jin Kim – South Korean government bond futures ended mixed in overnight trading, despite a rally in US Treasuries.

According to the Seoul bond market on the 22nd, the 3-year government bond futures closed at 105.93, up 3 ticks from the previous day’s regular session close. Foreign investors were net buyers of 1 contract, while financial investment institutions were net sellers of 1 contract.

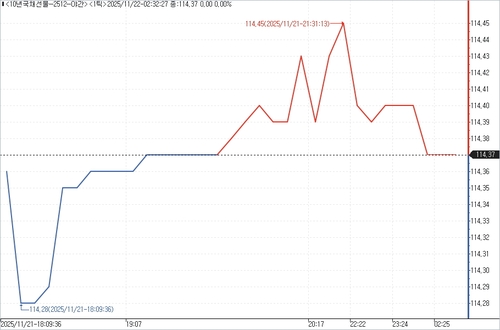

The 10-year government bond futures finished unchanged at 114.37, matching the previous session’s close. Foreign investors were net buyers of 54 contracts, while financial investment institutions and individuals were net sellers of 50 and 4 contracts, respectively.

Trading volume for the 3-year contract plunged to 8 contracts from 402 in the previous session. In contrast, 10-year contract volume rose to 81 from 61 contracts.

As of 07:00 KST, US Treasury yields were trending lower. The 10-year US Treasury yield fell by 2.10 basis points from the previous New York close, while the 30-year yield declined by 1.10 basis points. The 2-year yield dropped by 2.50 basis points.

Expectations for a US Federal Reserve rate cut in December surged following remarks by John Williams, President of the Federal Reserve Bank of New York and widely regarded as the Fed’s third most influential official. The probability of a rate cut reflected in the futures market for next month soared to around 70%, sharply overtaking expectations for a hold.

Speaking at the Central Bank of Chile’s centennial conference, Williams stated, “I still see the possibility of adjusting the target range for the federal funds rate further in the near term to move policy closer to a neutral stance.”

sjkim@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.