(Seoul=Yonhap Infomax) Seon Mi Jeong – The real effective value of the South Korean won, adjusted for purchasing power, has fallen to its lowest level since the global financial crisis.

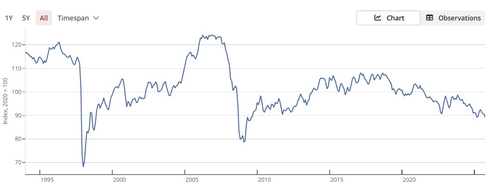

According to the Bank for International Settlements (BIS) on the 23rd, South Korea’s real effective exchange rate (REER) index for the won stood at 89.09 at the end of last month, marking the lowest level since August 2009, when it recorded 88.88.

This represents a decline of 1.44 points from 90.53 at the end of September. The previous post-crisis low was 89.29 in March this year, when heightened political uncertainty—including the imposition of martial law and the impeachment of former President Yoon Suk Yeol—triggered a sharp drop in the won’s real value.

The index is based on ‘2010 = 100’. A reading above 100 indicates the won is overvalued, while below 100 signals undervaluation. The REER reflects relative price changes and is a key indicator for assessing the real value of a currency.

Among 64 countries tracked, only Japan (70.4) and China (87.9) have currencies with a lower real effective value than the won.

The REER index has been on a steady downward trend since peaking at 107.94 in September 2018.

This year, the USD/KRW exchange rate briefly fell to 1,347.10 won per dollar at the end of June following the inauguration of the new government. However, since mid-September, the rate has climbed sharply after the US Federal Reserve (Fed) adopted a more hawkish stance on rate cuts, reaching 1,475.50 won per dollar as of the 21st—the highest since April 9.

The average USD/KRW exchange rate rose from 1,389.66 won in August to 1,391.83 won in September and 1,423.36 won in October, an increase of more than 30 won in just one month.

With the exchange rate surging by over 50 won in November alone, the won’s real value is expected to decline further this month.

| Date | USD/KRW Exchange Rate |

|---|---|

| 2025-11-21 | 1,475.5000 |

| 2025-10-31 | 1,423.3600 |

| 2025-09-30 | 1,391.8300 |

| 2025-08-31 | 1,389.6600 |

| 2025-06-30 | 1,347.1000 |

Trend Analysis: The won’s real effective value has been on a persistent decline since 2018, with recent political and monetary policy developments accelerating the depreciation. The sharp rise in the USD/KRW exchange rate in the second half of 2025 underscores mounting pressure on the currency, with further declines in real value expected if current trends persist.

smjeong@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.