(Seoul=Yonhap Infomax) Soo Yong Lee – As the average age of insurance agents in South Korea continues to rise, concerns are mounting over increased risks of misselling, prompting calls for the active use of artificial intelligence (AI) to support their work.

Kim Seok-young, Senior Research Fellow at the Korea Insurance Research Institute, stated in a report titled "Aging of Insurance Agents and Its Implications" released on the 23rd, "To improve the retention rate of newly recruited older agents, it is necessary to leverage AI, while also introducing institutional safeguards to address potential issues arising in the process."

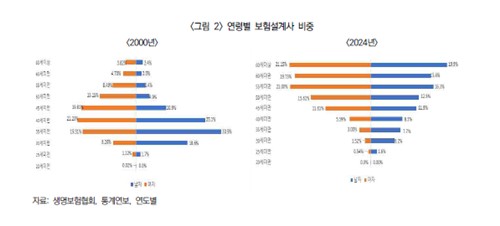

The average age of exclusive life insurance agents has steadily increased—from 36 years for men and 40.6 years for women in 2000, to 48.7 years for men and 51.8 years for women in 2024.

Newly recruited insurance agents often struggle to settle into the profession due to lack of experience in their first year. As a result, the proportion of long-tenured agents has grown, further pushing up the average age of the agent workforce.

Additionally, the demographic of candidates taking the insurance agent qualification exam is aging rapidly. The share of candidates in their 20s and 30s fell from 22% and 37% in 2010 to 12% and 20% in 2024, respectively, while those aged 60 and above surged from 0.48% to 10% over the same period.

This trend is attributed to baby boomers choosing insurance sales as a new career path after retirement.

However, insurance products are becoming increasingly complex. Protection-type products now feature more coverage options and stricter payout conditions, while advances in medical technology are giving rise to new treatments and corresponding insurance offerings.

Older agents may face difficulties in accurately explaining these complex products to consumers.

"The sales process for agents involves customer outreach, building rapport, persuasion, and product explanation. The product explanation stage, in particular, should transition to a system where AI plays a central role," Kim said. "There is a need for regulatory review to clearly delineate the roles of agents and AI in the sales process."

He added, "Utilizing AI to explain the structure and coverage details of complex insurance products can help prevent misselling and improve the retention rate of older agents."

sylee3@yna.co.kr

(End)

Copyright (c) Yonhap Infomax. All rights reserved. Unauthorized reproduction or redistribution, as well as AI training and utilization, are strictly prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.