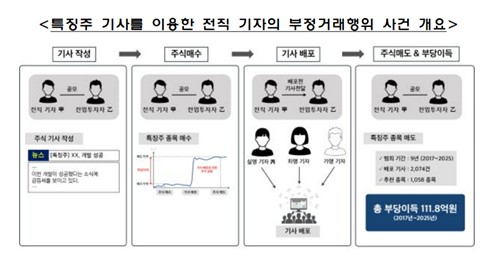

(Seoul=Yonhap Infomax) Gyeong Eun Park = The Financial Supervisory Service (FSS) has uncovered illicit trading activities by a former journalist who exploited stock feature articles for personal gain. Over a nine-year period, the suspects published more than 2,000 articles, amassing illicit profits totaling 11.18 billion won ($8.3 million).

The FSS Capital Markets Special Judicial Police announced on the 23rd that it had detected unfair trading practices involving the use of feature articles by a former reporter.

The FSS’s investigation division launched a targeted probe following a tip-off, uncovering multiple instances of front-running by both current and former journalists leveraging stock feature articles.

Following a resolution by the Securities and Futures Commission, the case was referred to the Seoul Southern District Prosecutors’ Office, which began directing the investigation in March.

Currently, 15 suspects remain under investigation. The special judicial police have conducted raids and digital forensic analyses at more than 50 locations, including media outlets.

The main perpetrators, former reporter A and full-time investor B, have been detained and were referred to prosecutors for indictment on the 21st.

The suspects exploited the surge in retail investor buying that typically follows the publication of stock feature articles via securities firms’ home trading systems (HTS) and major news portals.

They would purchase shares of targeted companies before publishing the articles, then place high-priced sell orders to capitalize on the anticipated post-publication buying frenzy.

Stocks selected were primarily small- and mid-cap shares with low trading volumes or high price volatility. Reporter A wrote feature articles based on favorable information obtained about listed companies.

Additionally, A secured article distribution rights from multiple media outlets under the guise of investor relations (IR) business, publishing articles under a spouse’s name or fictitious identities.

These articles were shared with investor B prior to publication.

A also leveraged personal connections to obtain advance copies of articles written by another reporter, C, using them for front-running trades.

The FSS special judicial police stated, “We will expedite investigations into the remaining suspects and respond strictly and without exception to any actions that undermine fair trading in the capital markets.”

gepark@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.