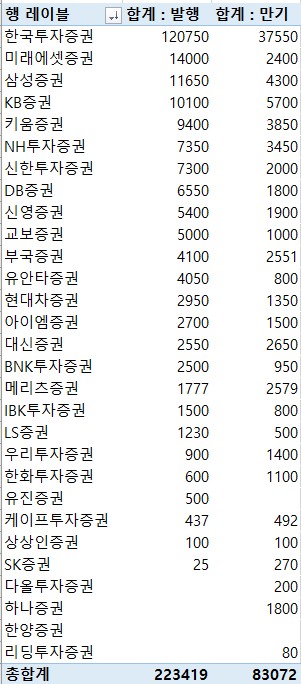

(Seoul=Yonhap Infomax) Kyu Sun Lee – South Korea's 25 major securities firms issued a combined KRW 22.3419 trillion ($17.1 billion) in commercial paper (CP) and electronic short-term bonds (E-STB) during the week of November 17–21, according to Yonhap Infomax CP/E-STB Integrated Statistics (Screen No. 4720) released on the 24th.

Korea Investment & Securities Co. led the market, issuing KRW 12.075 trillion in CP and E-STB. Mirae Asset Securities Co. followed with KRW 1.4 trillion, while Samsung Securities Co. issued KRW 1.165 trillion.

In comparison, the previous week (November 10–14), 24 securities firms issued a total of KRW 16.9479 trillion.

For the current week (November 24–28), the volume of CP and E-STB maturing at 25 securities firms is projected at KRW 8.3072 trillion ($6.4 billion). Of this, Korea Investment & Securities Co. faces maturities of KRW 3.755 trillion, while KB Securities Co. has KRW 570 billion maturing.

Last week (November 17–21), the total amount of CP and E-STB matured at securities firms stood at KRW 6.416 trillion.

kslee2@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.