(Seoul=Yonhap Infomax) Kyu Sun Lee – The global competition among major tech giants in the artificial intelligence (AI) sector is increasingly resembling an arms race, making excessive investment and the formation of a bubble unavoidable, according to a recent analysis.

Park Seung-young, a researcher at Hanwha Investment & Securities, stated in a report on the 24th, "Companies investing in AI are prioritizing market share expansion in new sectors over maximizing efficiency." He added, "Overinvestment aimed at driving out competitors is inevitable, and an AI bubble will be unavoidable in this process."

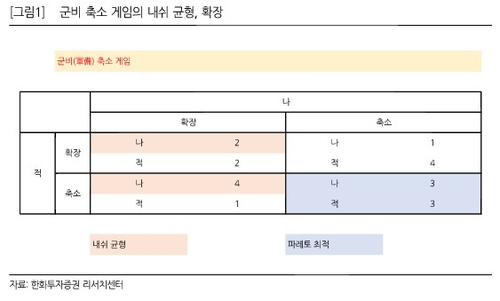

Park likened the current AI investment race to the 'arms reduction game' in game theory. While the 'Pareto optimal' outcome—maximizing overall national utility—would be for all countries to reduce arms, the best choice for each individual country (Nash equilibrium) is to increase armaments.

"If a rival reduces its arms while I increase mine, I can dominate; if the rival increases, I must also increase to ensure security," Park explained. "This is why, when one company announces a funding plan, competitors quickly follow suit with similar announcements."

Amid this dynamic, major tech firms are also seen expanding their leverage.

The combined cash and cash equivalents of the top five big tech companies—Microsoft, Amazon, Alphabet, Meta, and Oracle—account for 8.8% of their total assets. While their current debt ratio is below 40%, it is projected to rise to 45.8% when factoring in recently announced corporate bond issuances.

However, Park drew a line, saying these financial burdens are not yet cause for concern.

"There are worries about big tech firms raising funds through corporate bonds, but securing long-term capital via bonds is a shareholder-friendly move," he said. "Issuing shares when valuations are high, despite strong financials, is actually a red flag—this is not the case now."

Park maintained a positive outlook on the domestic stock market as well.

"It is only natural for South Korean semiconductor companies to ramp up investment in response to rising demand," he said. "We remain constructive on the domestic equity market, and increasing exposure to small- and mid-cap stocks ahead of early next year could be a prudent strategy."

kslee2@yna.co.kr

(End)

<Copyright (c) Yonhap Infomax, unauthorized reproduction and redistribution prohibited, AI learning and utilization prohibited>

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.