(Seoul=Yonhap Infomax) Kyu Sun Lee – Hanwha Investment & Securities Co. and Mirae Asset Securities Co. have secured licenses to operate Integrated Investment Accounts (IMA), often dubbed “dream accounts” in South Korea’s financial sector. However, analysts caution that immediate, dramatic improvements in earnings are unlikely due to stringent reserve requirements tied to principal guarantees.

Hee-yeon Lim, analyst at Shinhan Investment Corp., stated in a report on the 24th, “While the IMA business is now accessible, it will take time to contribute meaningfully to earnings. Unlike short-term note issuance, IMAs require a higher proportion of long-term asset management and mandatory reserve accumulation, limiting short-term profit generation.”

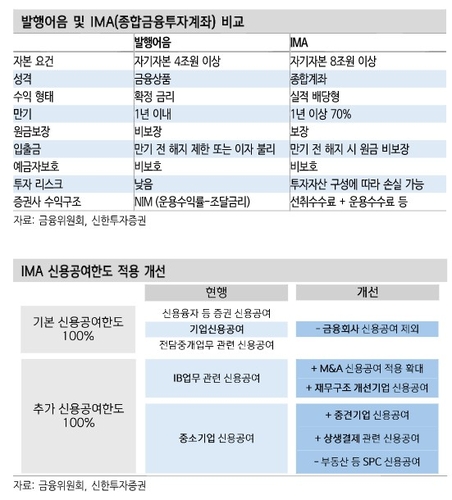

On the 19th, the Financial Services Commission (FSC) designated Hanwha Investment & Securities and Mirae Asset Securities—each with over 8 trillion won ($6.1 billion) in equity capital—as comprehensive financial investment business operators eligible to manage IMAs. The IMA is a performance-based product in which securities firms guarantee principal and return yields above bank deposit rates to clients.

While the market anticipates significant capital inflows, Lim highlighted the cost burden. IMAs, as principal-guaranteed products, require firms to set aside 5% of entrusted funds as loss reserves. Additionally, at least 70% of sourced funds must be invested in long-term assets (over one year), a regulation that reduces capital efficiency compared to short-term note issuance, where asset turnover is higher and management is more flexible.

“IMAs may attract clients seeking higher potential returns than bank deposits, but the heavy reserve requirements make immediate profit contribution difficult,” Lim added. “Rather than boosting profitability, IMAs are likely to serve as ‘bait products’ to expand wealth management (WM) client bases or drive top-line growth.”

Enhanced obligations to supply venture capital also pose challenges. Regulators require that 25% of IMA-sourced funds be invested in venture capital. Notably, investments in mid-sized companies and A-rated bonds—considered lower risk—are recognized for only up to 30% of the mandatory allocation. This compels securities firms to take on greater risk to meet regulatory requirements.

“Meeting the venture capital investment quota will require firms to assume more risk, making asset management capabilities and risk control systems critical to performance,” Lim noted.

Meanwhile, Shinhan Investment Corp. maintained Korea Financial Group as its top sector pick.

kslee2@yna.co.kr

(End)

Copyright (c) Yonhap Infomax. All rights reserved. Unauthorized reproduction or redistribution, and AI learning or utilization, are strictly prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.