(Seoul=Yonhap Infomax) Seul Gi Yoon – Toss, a leading South Korean fintech platform, has unveiled a mid- to long-term plan to provide financial education to 10,000 individuals from financially vulnerable groups by 2028.

While digital finance adoption is accelerating, financial literacy among South Koreans remains below the minimum benchmark set by the Organisation for Economic Co-operation and Development (OECD). Demand for education is rising, particularly among at-risk groups facing higher delinquency rates in services such as Buy Now, Pay Later (BNPL) and micro deferred payment schemes.

According to the Korea Financial Consumers Protection Foundation, a recent OECD Digital Financial Literacy survey of 2,500 adults aged 19–69 nationwide found that the average score for South Korean adults was 59.3 out of 100, significantly below the OECD’s recommended minimum of 70.

The survey assessed not only understanding of digital financial services—such as internet banking, simple payments, and virtual assets—but also broader competencies including personal data protection, security, and legal recourse.

By age group, those in their 50s scored highest (60.9), followed by those in their 40s (60.8) and 60s (60.5). The lowest scores were recorded among people in their 20s (54.2), highlighting a lack of awareness regarding data security and the legal status of cryptocurrencies. Notably, the generation most active in digital finance demonstrated the lowest financial literacy.

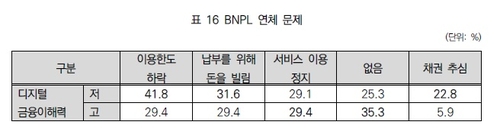

BNPL and micro deferred payment services are also expanding rapidly. Awareness of BNPL reached 89.9% among respondents, but 9.7% of users reported experiencing payment delinquencies. The delinquency rate was particularly high among those in their 20s (15.7%) and 30s (10.3%), compared to the overall average. Among households with monthly income below 3 million won ($2,250), the delinquency rate stood at 18.5%, while those with low digital financial literacy recorded an 11.3% rate. This underscores the structural vulnerability of low-literacy groups to delinquency risk.

Market data confirms a rising trend in delinquency rates. Kakao Pay’s micro deferred payment delinquency rate rose to 2.62% at the end of last year, up 0.9 percentage points from 1.72% in the first half. Naver Pay’s rate increased from 1.31% to 1.44%, and Toss (Viva Republica) saw a rise from 1.21% to 1.27% over the same period. At one point, the average delinquency rate among the three major players reached 5.8%, prompting write-offs, but the upward trend has resumed.

Amid concerns that the rapid expansion of digital finance is widening the gap with financial literacy and safety nets, Toss has set a cumulative target of educating 10,000 financially vulnerable individuals by 2028.

Last year alone, Toss conducted 56 on-site financial education sessions, totaling over 100 hours. Approximately 3,000 participants have joined the program to date, collectively logging 300,000 hours of learning.

One flagship initiative is the “Basic Finance for Everyday Life” program, tailored for children in care facilities and young adults preparing for independence. The curriculum covers foundational topics such as savings, credit management, and budgeting, as well as practical issues like voice phishing and rental fraud prevention. In August and November, Toss partnered with Seoul Housing & Communities Corporation (SH) to deliver hands-on financial management and fraud prevention training to young people about to leave care facilities. Participant satisfaction averaged 4.9 out of 5.

Another six-month program, the “Borderline Intelligence Youth Financial Self-Help Group,” was conducted in collaboration with the Seoul Lifelong Education Support Center for Borderline Intelligence (MIM Center) and social enterprise Free Whale. As a result, participants’ financial literacy scores improved from 44 to 79, and behavioral assessments in areas such as financial attitudes, income management, spending habits, and credit management rose from an average of 3.5 to 4.2.

Toss is also expanding financial education for the visually impaired. In partnership with the Korea Blind Welfare Center, the curriculum focuses on asset management and insurance—areas often inaccessible to the visually impaired. The Toss Insurance education team provided direct instruction on practical topics such as premium reduction and coverage analysis.

A Toss official stated, “Financial literacy is the power to design and protect one’s own life. We will expand our educational outreach to all financially vulnerable groups, including retirees, and provide practical financial education to 10,000 people by 2028.”

Experts warn that the convergence of rising BNPL delinquency rates and declining financial literacy constitutes a “structural risk,” calling for a combination of public education policies and private sector participation.

An official at a financial policy research institute commented, “The rise in BNPL and deferred payment delinquencies and the decline in digital financial literacy are mutually reinforcing structural risks. Public financial education policies and private sector involvement must work in tandem to prevent repeated delinquencies among vulnerable groups.”

The official added, “With digital finance now a part of daily life, leaving an environment where ‘spending is easy but understanding is hard’ unaddressed could see delinquency issues recur in different forms. The key is how private sector education initiatives can be integrated with institutional financial and educational policies, rather than remaining one-off CSR activities.”

sgyoon@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.