(Seoul=Yonhap Infomax) Yo Been Noh –

External headwinds that recently weighed on South Korea's benchmark KOSPI index are easing, prompting analysts to recommend maintaining positions in leading stocks.

In a report released on the 24th, Kim Jae-seung, analyst at Hyundai Motor Securities, stated, "We expect some of the factors that have driven KOSPI weakness since December, particularly U.S. liquidity tightening, to reverse."

Kim noted that liquidity pressures in the U.S. short-term funding market are likely to ease following the end of the federal government shutdown and policy actions by the Federal Reserve (Fed).

Overnight, expectations for Fed rate cuts increased, driven by signs of easing inflation and a weakening labor market.

"The Fed's potential end to quantitative tightening on December 1 and the rising likelihood of a policy rate cut at the December FOMC will help alleviate some of the market's liquidity concerns," Kim added.

The KOSPI has declined 8.7% from its recent peak of 4,226.75 as of the 4th. This suggests the index may be nearing the end of its correction phase.

"Since 2000, bull markets have typically experienced corrections of around 10%," Kim said. "If the bull market's momentum remains intact, the KOSPI has historically recovered to previous highs within 41 to 61 days from the bottom."

He added, "It can take up to two months for the index to recover to its previous high after a correction. If the KOSPI is forming a bottom now, it could attempt to break through its previous high again between late December and January."

If the index exits its short-term correction, leading stocks that experienced significant declines are expected to rebound sharply.

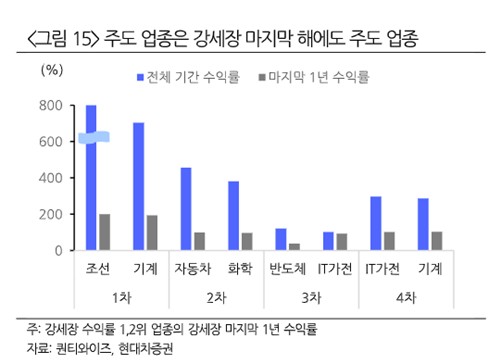

"Looking at sector returns around the KOSPI's bottom, those with the steepest declines tended to rebound the most," Kim said.

"Investors should hold onto leading sectors until the bull market ends," he emphasized. "Semiconductors and electrical equipment (power machinery) are leading this bull market, and these sectors, which are linked to the global AI theme, should remain in portfolios."

ybnoh@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.