(Seoul=Yonhap Infomax) Gyeong Eun Park – Investment Management Accounts (IMAs), which guarantee principal like deposits while offering corporate lending returns akin to private equity funds, are poised to fill the investment void between these two asset classes.

Historically, corporate lending, mezzanine, pre-IPO, and policy fund-linked assets have been dominated by institutional investors. IMAs are expected to serve as a ‘key’ to unlock these markets for retail investors, signaling not only a shift in securities firms’ funding and management strategies but also a broader transformation in corporate finance capital flows.

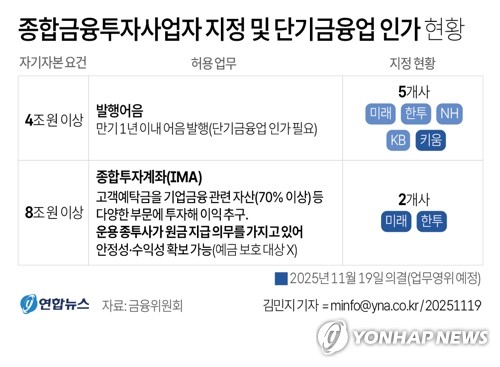

According to the financial investment industry on the 24th, Korea Investment & Securities Co. and Mirae Asset Securities Co. are in the final stages of preparing their inaugural IMA products, set to launch in early December.

Both firms are prioritizing stability in their first offerings. Given the unfamiliarity of IMAs among retail investors, they aim to deliver stable returns from the outset to highlight the products’ attractiveness compared to traditional deposits and savings accounts.

Nevertheless, investor focus remains on yield. The core strategies of both companies are designed to generate ‘alpha’—returns above prevailing interest rates. While adhering to the Financial Services Commission’s (FSC) guidelines for venture capital, both firms plan to include assets capable of delivering competitive yields.

Industry participants view IMAs as more than just a new product. They see them as the starting point for structural changes that could reshape funding methods and capital flows.

Securities firms will now have a new retail funding engine in addition to short-term notes. Unlike short-term notes, which primarily attract short-duration funds, IMAs can capture long-term capital, as their maturities can be flexibly set or structured as open-ended products.

This flexibility significantly reduces concerns over duration mismatches between assets and liabilities—a key risk in managing retail-based funds. For securities firms, IMAs provide an additional tool for asset-liability management (ALM).

IMAs also offer advantages in terms of Net Capital Ratio (NCR) requirements. Under new FSC guidelines, if 5% of managed assets are set aside as loss reserves, the risk weighting for NCR calculations is halved. This expands the range of loans and alternative assets that can be included with the same capital base, enhancing the capacity to manage corporate finance portfolios.

“It’s attractive as a vehicle because it gives us another tool to balance the company’s own books,” said Woo Sang-hee, head of IMA at Korea Investment & Securities Co. “Since IMAs are subject to only half the NCR charge, they also offer advantages in terms of capital utilization.”

IMAs are also expected to reshape the corporate funding landscape. For the first time, retail capital will flow structurally into areas previously dominated by institutional and policy finance. With mandatory venture capital allocations, IMAs are likely to become new funding sources for issuance, lending, and unlisted company segments.

“We expect a qualitative shift in the issuance market,” said Park Nam-young, head of IMA at Mirae Asset Securities Co. “With new capital inflows, transparency will increase, and more companies will seek to engage with the market.”

Woo added, “Acquisition finance for small and medium-sized enterprises (SMEs) will also be activated. While acquisition finance was previously limited to mid-sized firms, this area will now expand.”

Synergies with policy funds such as the National Growth Fund and the Korea Fund of Funds are also anticipated. Policy funds can play a risk-mitigation role, while IMAs channel private capital, enabling companies to design more diverse funding structures.

“There are areas where investment is difficult with only private capital,” Woo said. “For securities firms with venture capital supply obligations, policy funds will be valuable partners.”

He added, “This will create a major platform to attract companies in need of funding, so we are considering how best to contribute.”

Park also noted, “The risk diversification effect of policy funds is clear, making this aspect attractive. Investment portfolios can become much more diversified, allowing us to meet venture capital requirements and achieve a win-win effect.”

gepark@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.