(Seoul=Yonhap Infomax) Ha Rin Song – Despite heightened volatility in South Korea’s equity markets, margin lending balances—a key indicator of leveraged retail investing known locally as ‘Bittu’ (borrowing to invest)—have surged to all-time highs.

Securities firms have rapidly increased their capital bases through rights offerings and other measures, significantly expanding their lending capacity. As a result, the industry is no longer resorting to suspending margin lending as a risk control measure, a sharp contrast to 2021.

According to Yonhap Infomax’s market funds tracker (screen no. 3030) on the 24th, outstanding margin loans reached a record 26.8471 trillion won ($20.7 billion) as of the previous trading day, continuing their upward trajectory.

Margin lending refers to brokerage firms providing individual investors with funds to purchase equities. Under current regulations, brokerages can extend margin loans up to 100% of their equity capital.

Although leveraged investing is rising rapidly, securities firms are now only moderating the pace, rather than imposing outright suspensions. This marks a departure from 2021, when margin lending was halted across the industry after balances exceeded 25 trillion won ($19.3 billion) and lending limits were reached.

The shift reflects the industry’s strategic pivot toward capital-based businesses, such as issuance of promissory notes and Integrated Money Accounts (IMA)—Korea-specific investment products. Firms have aggressively expanded their capital to qualify as comprehensive investment business entities (so-called ‘Jongtusa’), which are permitted to operate these businesses.

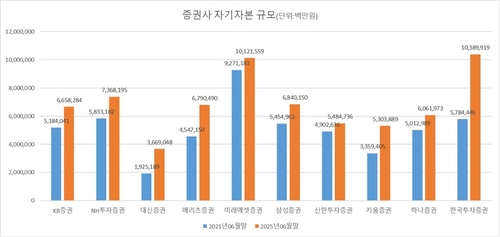

As of June this year, the combined equity capital of the top 10 securities firms stood at 68.7 trillion won ($53.1 billion), up 34% from June 2021.

Mirae Asset Securities Co. and Korea Investment & Securities Co. have both surpassed 10 trillion won ($7.7 billion) in equity capital. Korea Investment & Securities boosted its capital to 12 trillion won ($9.3 billion) through multiple rights offerings and hybrid capital securities issuances.

NH Investment & Securities Co. also raised its equity capital to 8 trillion won ($6.2 billion) via a 650 billion won ($500 million) rights offering in August, aiming to challenge the IMA market leaders.

Capital expansion has directly translated into greater margin lending capacity. Mirae Asset Securities, the industry leader by equity capital, saw its margin loan balance reach 7.2 trillion won ($5.6 billion) at the end of September, up 1.6 trillion won ($1.2 billion) from the end of last year.

Retail-focused brokerages Samsung Securities Co. and Kiwoom Securities Co. also reported margin loan balances of 4.2 trillion won ($3.2 billion) each as of September, up 400 billion won ($310 million) and 800 billion won ($620 million), respectively, since the start of the year. Based on their June 2021 capital levels, Kiwoom Securities has already exceeded its previous lending limit.

Interest income from margin lending has also grown substantially. Kiwoom Securities posted 96.4 billion won ($74.5 million) in margin lending interest income in Q3, up 24% from the end of last year. Mirae Asset Securities’ client credit profit reached 87.2 billion won ($67.4 million), a 37% increase over the same period.

“Looking back over the past decade, the way securities firms generate profits has fundamentally changed,” said Kim Hyun-soo, analyst at SangSangIn Securities. “Previously, higher trading volumes meant more commission income, but now, capital-based earnings have become a much larger share.”

hrsong@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.