(Seoul=Yonhap Infomax) Kyu Sun Lee –

The share of demand for A-rated corporate bonds is projected to expand from 3% in 2026 to 6% in 2027 and 7.5% in 2028.

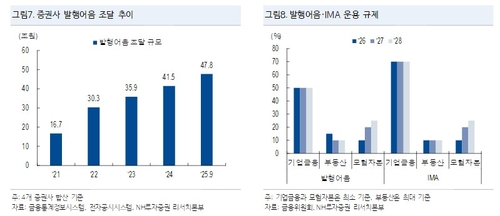

South Korea’s leading brokerages—Korea Investment & Securities Co., Mirae Asset Securities Co., and Kiwoom Securities Co.—have recently received new licenses for Integrated Managed Accounts (IMA) and short-term financial business (issuance of short-term notes). This development is expected to position these firms as major buyers in the A-rated corporate bond market.

Choi Sung-jong, a researcher at NH Investment & Securities Co., stated in a report on the 24th, “Considering the new business licenses, mandatory corporate finance ratios, and the proportion of assets that can be managed autonomously, the designation of new comprehensive investment business entities is positive for corporate bond demand.” He added, “In particular, it will generate new demand for corporate bonds rated A or below.”

The Financial Services Commission (FSC) last week designated Korea Investment & Securities and Mirae Asset Securities—each with over 8 trillion won ($6.1 billion) in equity capital—as IMA operators, and Kiwoom Securities—with over 4 trillion won ($3.1 billion)—as a short-term note issuer.

The credit market is closely watching the “venture capital supply obligation” regulation introduced by financial authorities. Under this rule, a certain percentage of funds raised through short-term notes and IMAs (10% in 2026, rising to 25% in 2028) must be invested in venture or small and medium-sized enterprises (SMEs). Investments in mid-sized companies and A-rated bonds, which are considered lower risk, can only account for up to 30% of the required quota.

While some market participants have expressed concerns that this 30% cap could limit demand for A-rated bonds, Choi argued that the effect of generating new demand outweighs the restrictions.

“Despite the cap on recognition for venture capital investments, the creation of additional recognized quotas will drive new demand for A-rated and lower-rated corporate bonds,” Choi explained.

According to the report, factoring in the venture capital supply obligation and performance requirements, the maximum share of A-rated corporate bonds in total funds is expected to increase from 3% in 2026 to 6% in 2027 and 7.5% in 2028. As the overall assets under management (AUM) grow, the absolute amount of purchases will also rise, even within the capped ratio.

Basic “corporate finance obligation ratios” will also support corporate bond demand. At least 50% of funds raised via short-term notes and 70% of IMA assets must be allocated to corporate finance-related assets. Choi noted, “Corporate finance assets include the lowest or second-lowest investment-grade bonds, such as A-rated corporate bonds. To comply with these mandatory ratios, demand for corporate bonds will remain robust.”

Meanwhile, last week’s domestic credit market saw credit spreads (the yield gap between government and corporate bonds) widen across all sectors due to increased volatility in government bond yields.

Choi commented, “Top-rated bonds faced pressure from increased issuance, and both financial and corporate bonds reflected a bearish tone in the secondary market. However, as the week progressed, bargain-hunting demand emerged, limiting the extent of spread widening.”

The primary market remains active. All six companies that conducted book-building last week, including KT Corp. (AAA) and HDC Holdings (A), successfully raised more funds than initially targeted.

Choi forecast, “While market volatility is expected to persist ahead of this week’s Monetary Policy Board meeting, the favorable demand seen in the primary market and the entry of new comprehensive investment business entities are likely to lead to attempts to narrow credit spreads on corporate bonds.”

kslee2@yna.co.kr

(End)

© Yonhap Infomax. All rights reserved. Unauthorized reproduction, redistribution, or use for AI training is strictly prohibited.

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.