(Seoul=Yonhap Infomax) Jae Heon Lee =

Kia Corp. (000270), South Korea’s second-largest automaker, is losing visibility in the domestic equity market as its stock momentum weakens, further overshadowed by its larger affiliate, Hyundai Motor Co. (005380). Market watchers are closely monitoring whether value-seeking investors will return to Kia shares.

According to Yonhap Infomax’s daily stock transaction data (screen number 3121) as of the 24th, Kia’s total trading value so far this month stood at 1.461 trillion won ($1.13 billion). The average daily trading value dropped to 97.4 billion won ($75.5 million), down about 34% from the previous month and below this year’s average of 106.5 billion won ($82.6 million).

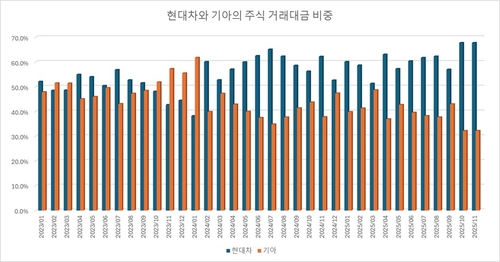

Investor indifference toward Kia is even more pronounced when compared to Hyundai Motor. This month, Kia’s share of Hyundai’s trading value was just 47.5%. For every 1 million won ($775) traded in Hyundai shares, less than 500,000 won ($387) was traded in Kia—a year-to-date low. Kia’s share of combined investments in Hyundai Motor Group’s two flagship automakers has fallen to roughly one-third.

Just two years ago, the landscape was different. Kia and Hyundai Motor posted nearly identical monthly trading values, with Kia occasionally surpassing Hyundai by more than 50% when its stock was seen as undervalued or showing stronger momentum. For investors focused on Hyundai Motor Group and the auto sector, Kia was not merely a “junior” affiliate but a peer with distinct appeal.

Market participants attribute Kia’s diminished status to the growing focus on corporate value enhancement and governance reform in South Korea’s stock market. Investors increasingly view Hyundai Motor as the group’s core beneficiary of resource allocation and future shareholder value, drawing buying interest toward Hyundai on expectations of greater returns from shareholder-friendly policies and governance restructuring.

Kia’s recent earnings shock, triggered by U.S. tariff concerns, has further driven investors away. As the performance gap with Hyundai Motor widened, more investors rotated out of Kia. In the second half of this year, Hyundai Motor’s share price surged 27%, while Kia gained only 17.1%.

“The pull of investment capital toward Hyundai Motor has intensified,” said a brokerage official. “There’s a perception that Kia’s unique growth potential is limited amid large-scale investments in both the U.S. and domestic markets.”

Some analysts say a reversal could occur if foreign investors ramp up Kia purchases, especially as the stock’s undervaluation becomes more pronounced. Foreign ownership in Kia, which exceeded 40% in mid-October, slipped to 39.68% as of the previous day.

jhlee2@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.