(Seoul=Yonhap Infomax) Sun Young Jung – The South Korean won and Japanese yen, which had both been weakening against the US dollar, have recently begun to diverge.

While the fundamentals of the won and yen are showing different trajectories, analysts say a broad-based weakening of the US dollar could see the two currencies move in sync once again.

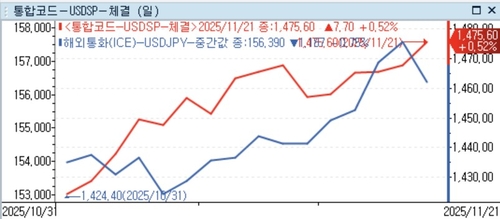

According to Yonhap Infomax’s daily trading summary (screen number 2150) on the 24th, the USD/KRW exchange rate has risen for five consecutive sessions, reaching a high of 1,476.00 won, while the USD/JPY rate, after hitting 157.89 yen on the 20th, retreated to the 156 yen level.

Until recently, the won had been weakening alongside the yen against the dollar, but growing concerns over Japanese authorities’ intervention have pushed the USD/JPY rate lower.

Both currencies have seen significant depreciation, heightening vigilance over potential intervention.

South Korea’s foreign exchange authorities stated that after the won breached the 1,470 level, they would work with the National Pension Service and exporters—major dollar sellers—to moderate the pace of the won’s decline.

Japanese authorities have also stepped up verbal intervention. Japanese Finance Minister Satsuki Katayama recently said the foreign exchange market was experiencing one-sided and rapid moves, adding, “FX intervention to address excessive volatility and speculative moves is one option.”

With the likelihood of actual intervention by Japanese authorities rising, the USD/JPY rate has pulled back.

Above the 1,470 won level, the pace of gains in the USD/KRW rate has slowed, due to hedging by the National Pension Service and exporter dollar sales.

Heightened intervention risk is now capping the upside for both exchange rates.

However, for the won and yen to continue moving in tandem, their respective fundamentals must also align.

The yen gained momentum from the launch of “Sanaenomics” on the 21st, boosting Japanese equities, but negative effects from worsening China-Japan relations have also grown.

Moon Nam-jung, global strategist at Daishin Securities, said, “The recent yen weakness approaching the 158 level since April 2024 increases the likelihood of intervention by the Japanese government and Bank of Japan (BOJ), as seen from April to mid-July. If the yen nears 160, side effects on the Japanese economy, such as real wages, could become more pronounced, and heightened China-Japan tensions would be a negative for Japanese equities.”

He added, “With China-Japan tensions likely to persist rather than ease quickly, negative sentiment toward the Japanese economy and stock market is expected to spread for the time being.”

Despite Japan’s large-scale stimulus, Japanese government bond yields have risen, and the narrowing US-Japan rate differential has increased caution over potential unwinding of yen carry trades.

The possibility of a BOJ rate hike is another variable for the yen. Should the BOJ raise rates, it could partially offset recent yen weakness.

By contrast, upside factors for the won remain limited. While expectations for a Bank of Korea rate cut have diminished, market experts say that heightened external uncertainty and risk aversion make it difficult for the won to strengthen significantly.

Lee Min-hyuk, FX economist at KB Kookmin Bank, said, “The Japanese yen has turned stronger on expectations of a BOJ rate hike. Governor Ueda indicated that if the Japanese economy and inflation evolve as expected, further rate hikes will follow, and the likelihood of this scenario has increased, suggesting a rate hike could come soon.”

Lee added, “This week, the USD/KRW rate is likely to test new highs amid deepening domestic and external uncertainty. With authorities poised to intervene and the National Pension Service ready to hedge, we see 1,480 won as a short-term ceiling.”

However, if the global dollar turns weaker, both the USD/KRW and USD/JPY rates are expected to reflect this shift.

The Federal Open Market Committee (FOMC) meeting scheduled for December 9–10 is weighing both rate cuts and a hold, but expectations for a cut remain dominant.

Park Sang-hyun, economist at IM, said, “We expect the dollar to be more weakly firm than strongly bullish through year-end. While the Fed’s rate decision is a key variable, the appointment of the next Fed chair in December and the impact of Prime Minister Takaiichi on yen weakness are also expected to diminish.”

He added, “While the Takaiichi cabinet’s larger-than-expected supplementary budget widened yen weakness, with the sharp rise in Japanese government bond yields, further fiscal expansion will be difficult, and the yen’s weakening trend may subside.”

syjung@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.